Cash Conversion Cycle PPT Slide Template

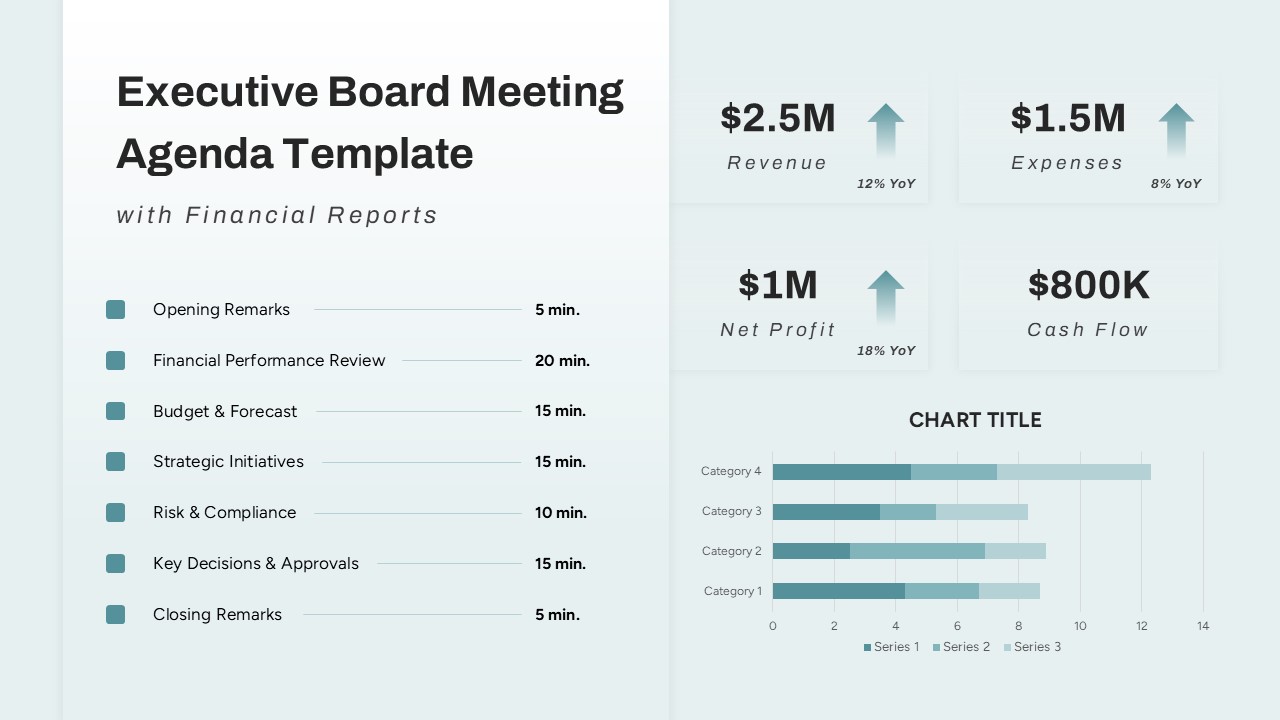

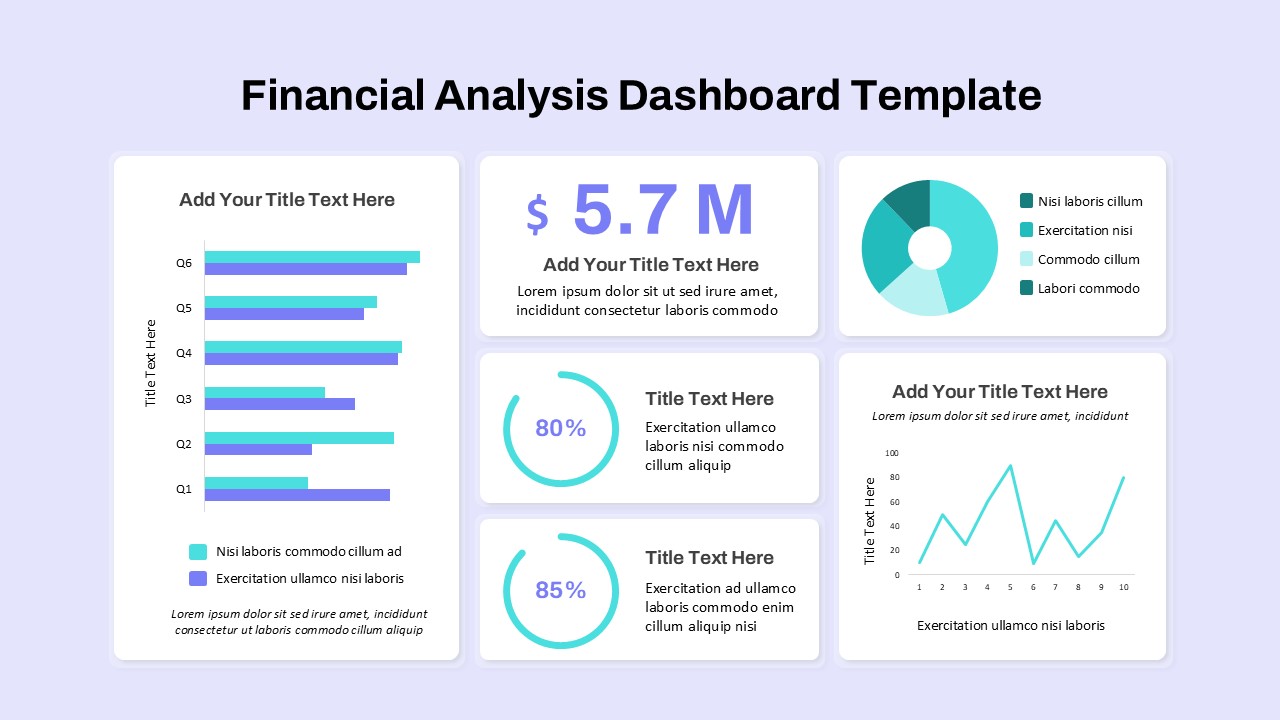

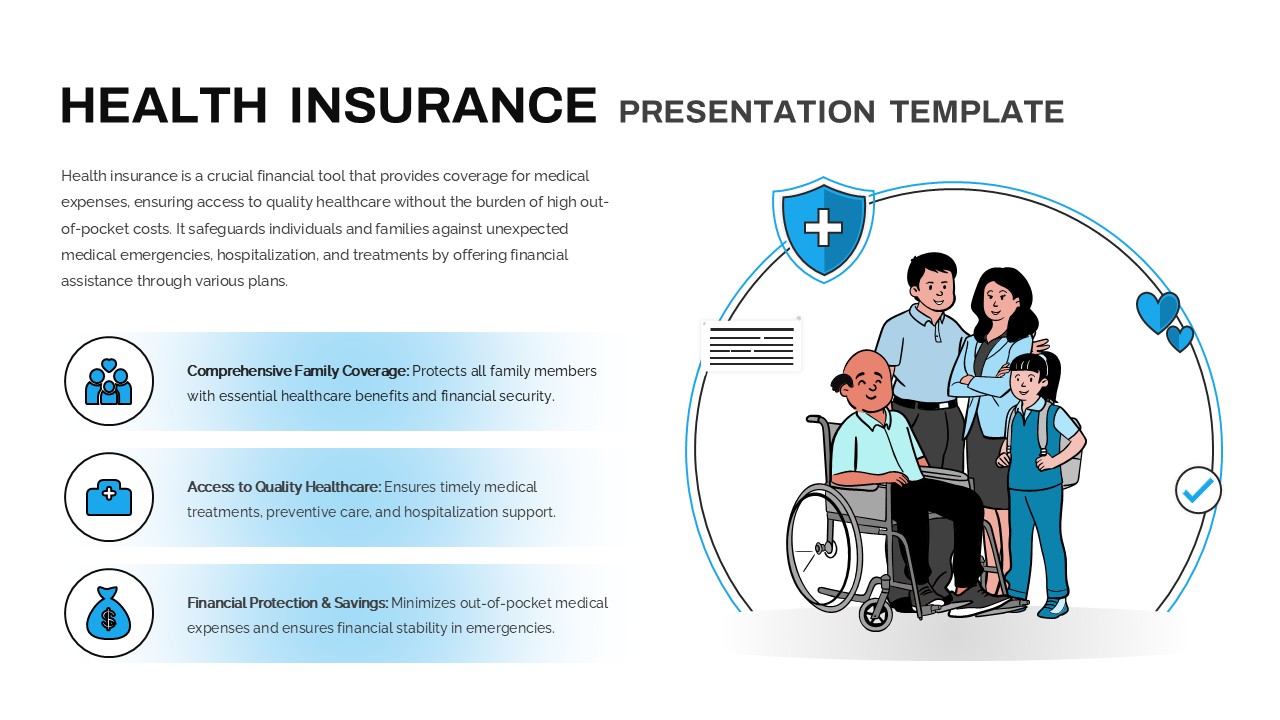

Enhance your financial presentations with this professionally designed Cash Conversion Cycle (CCC) PPT Template. Ideal for finance professionals, CFOs, analysts, and business educators, this template simplifies the explanation of how efficiently a company converts its investments in inventory and receivables into cash flow from sales.

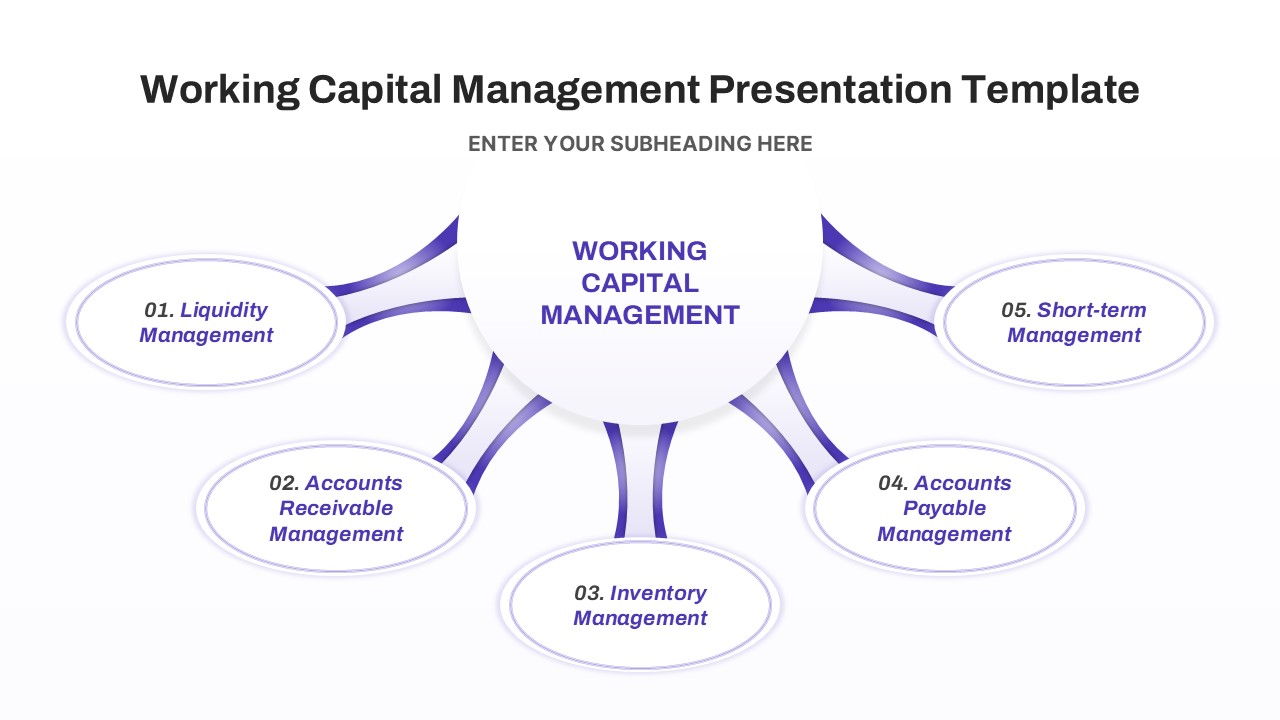

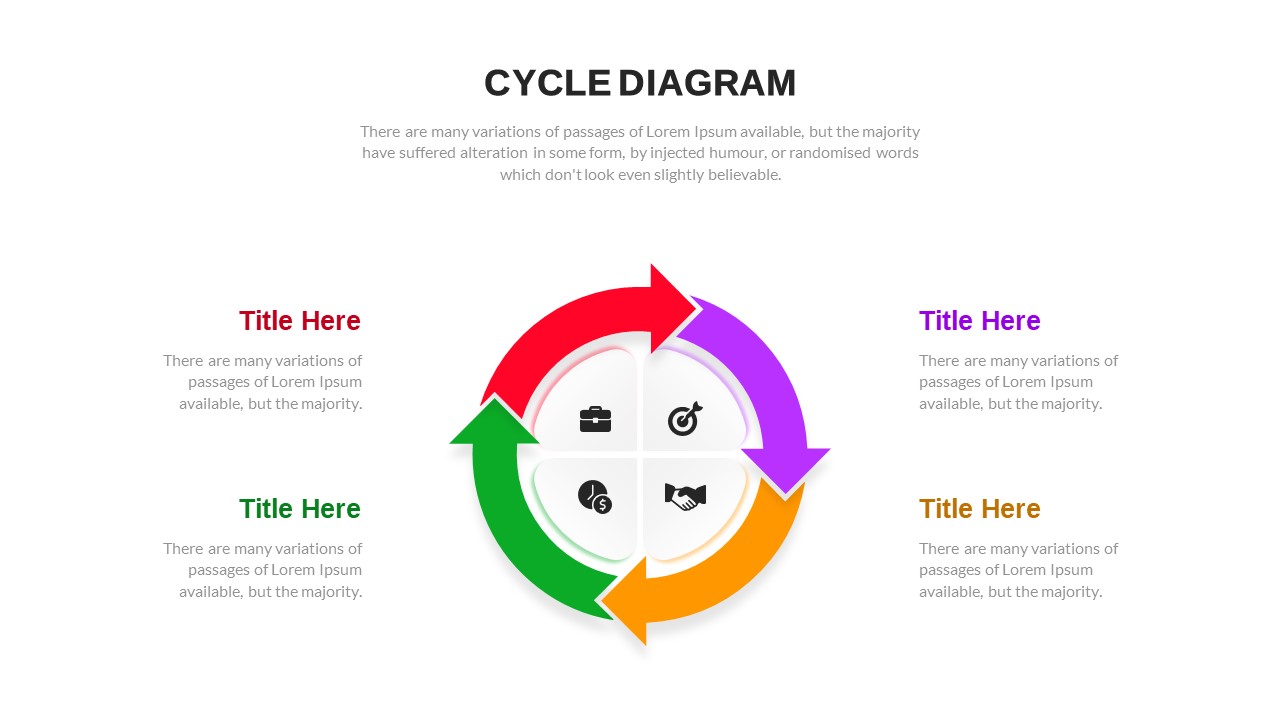

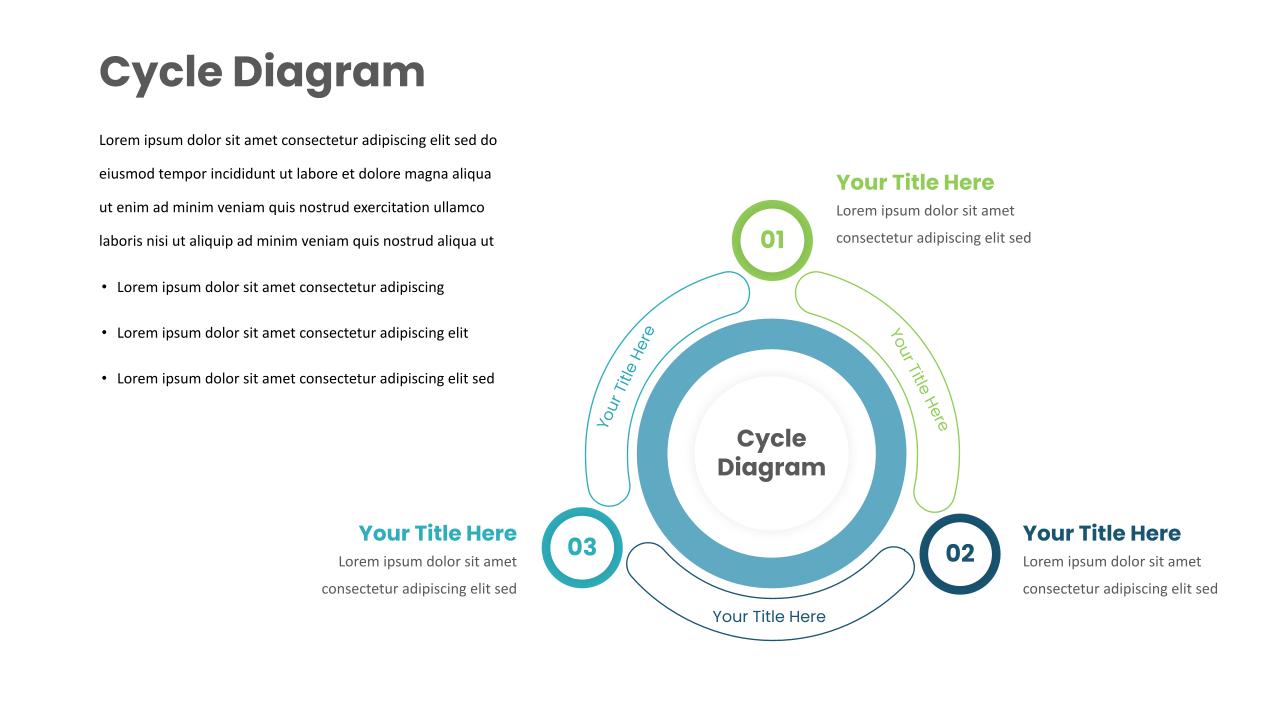

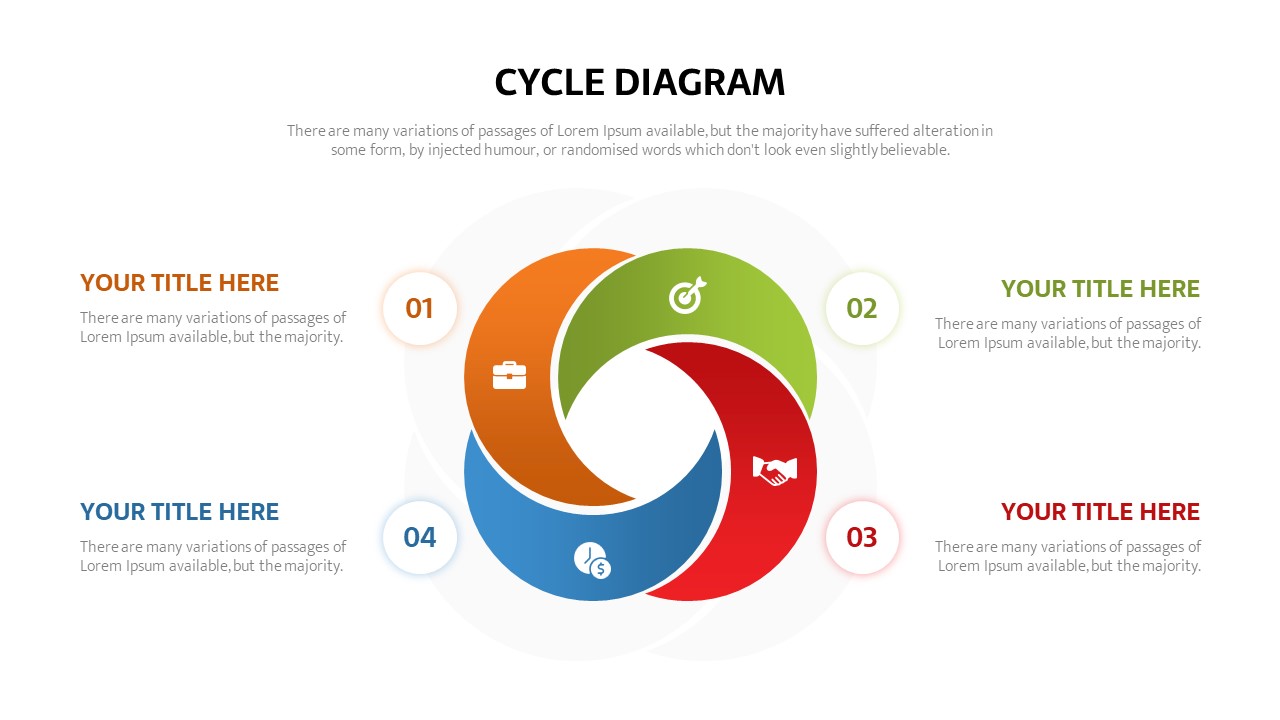

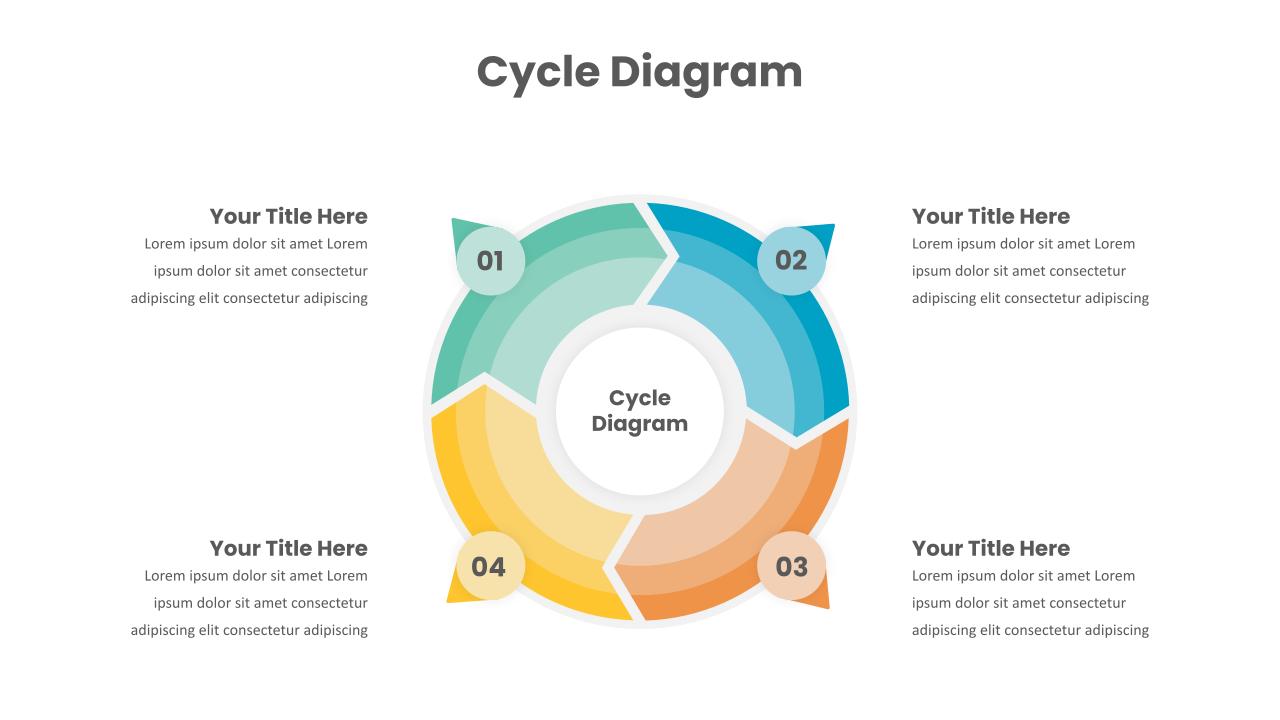

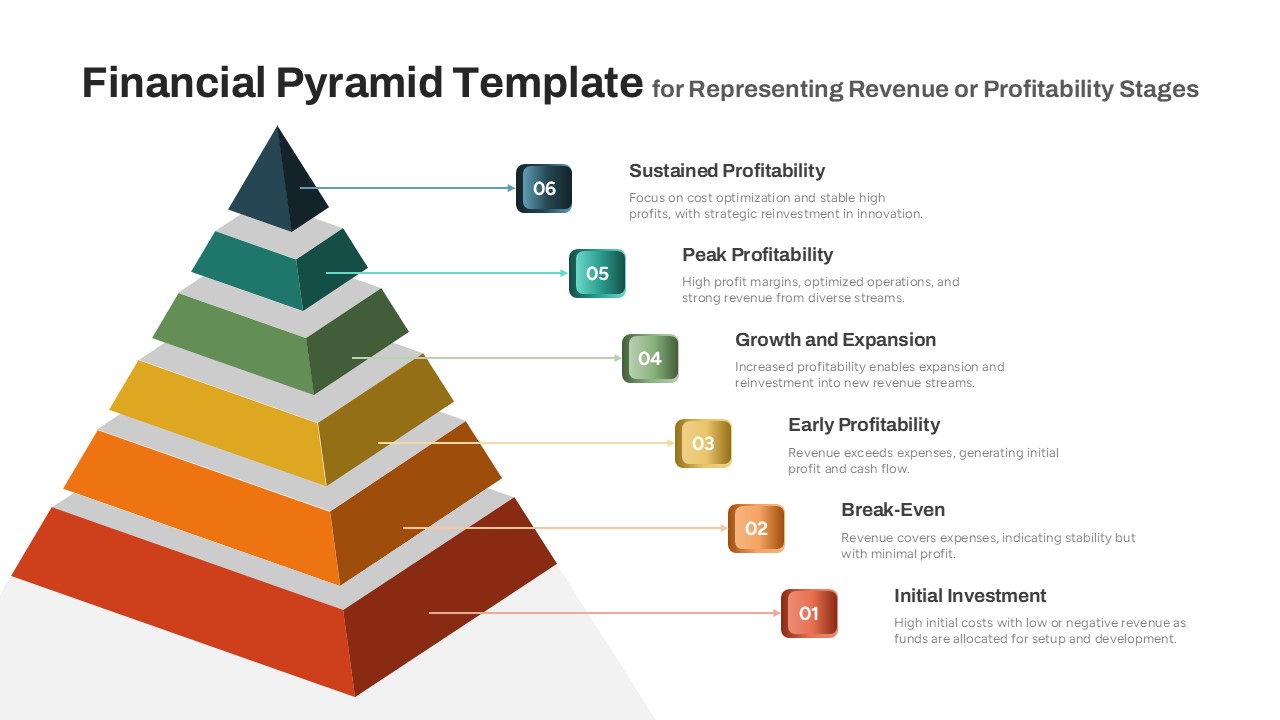

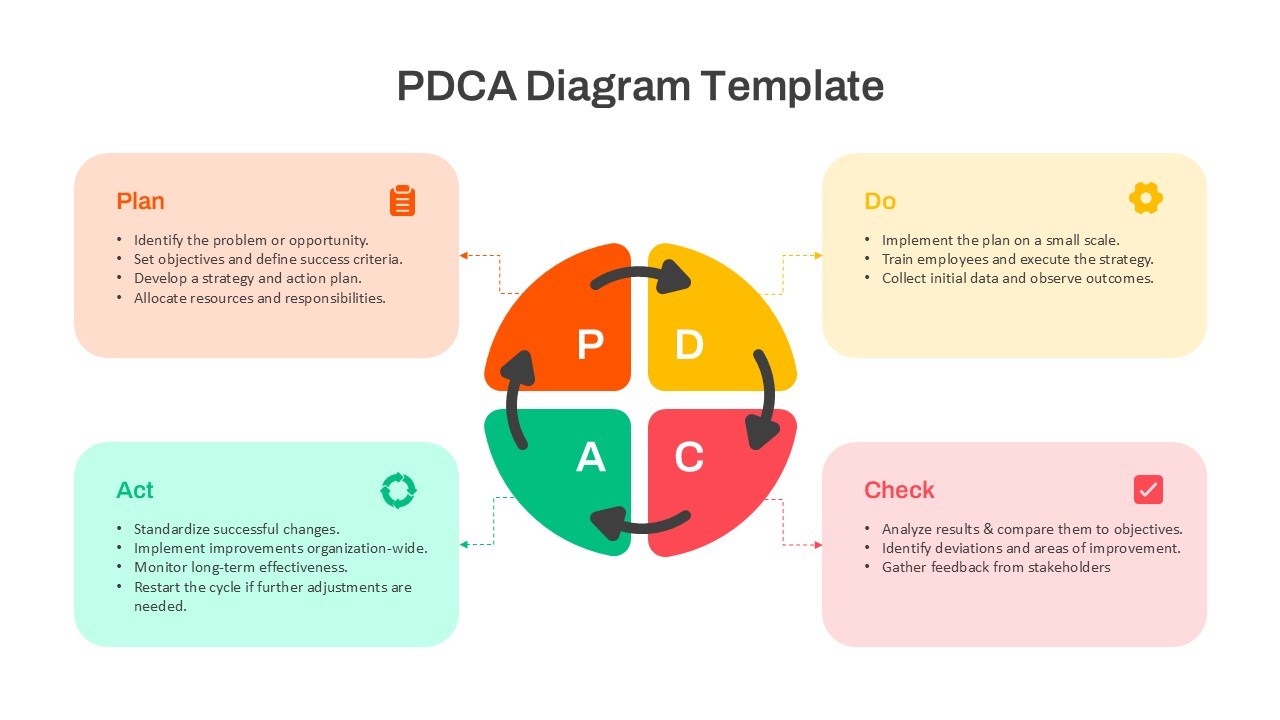

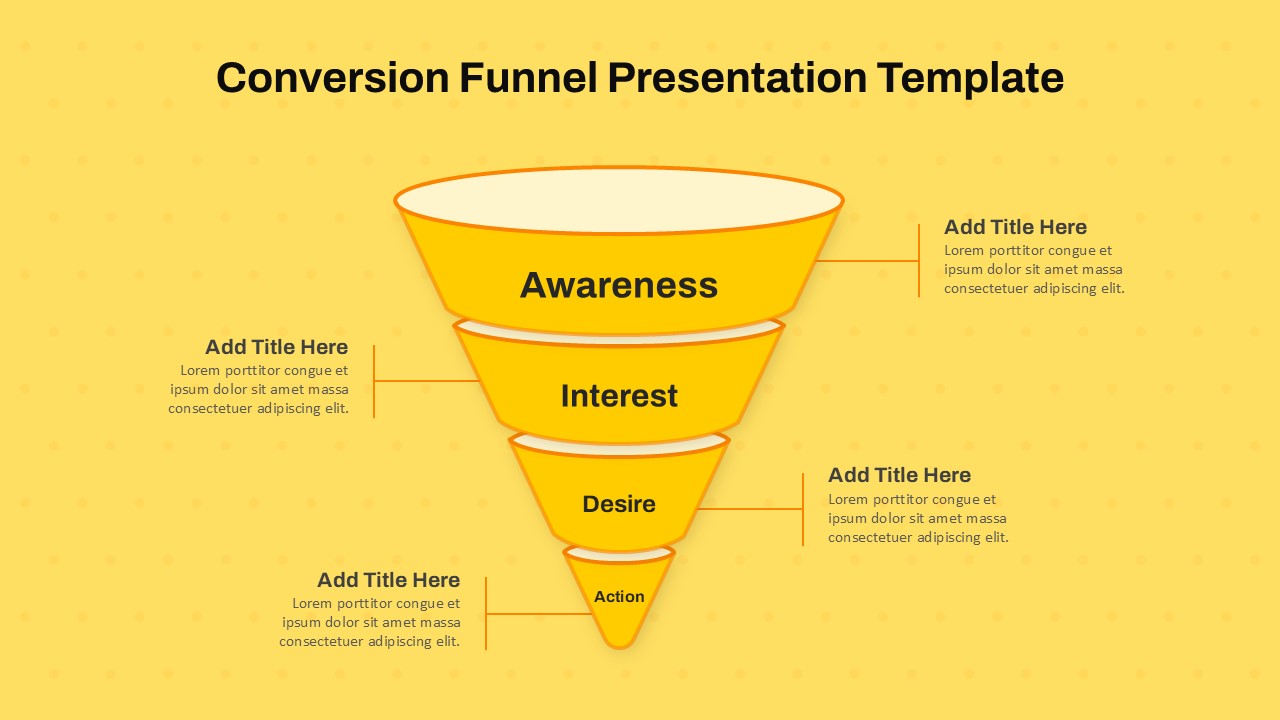

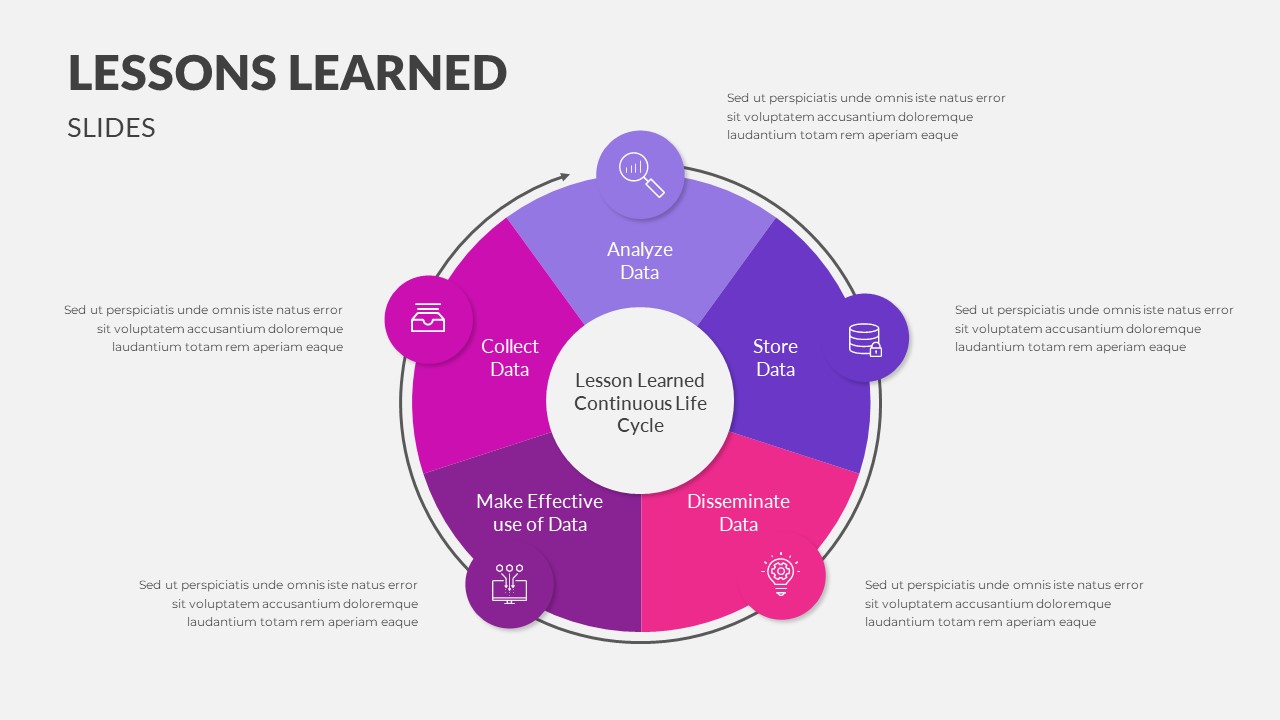

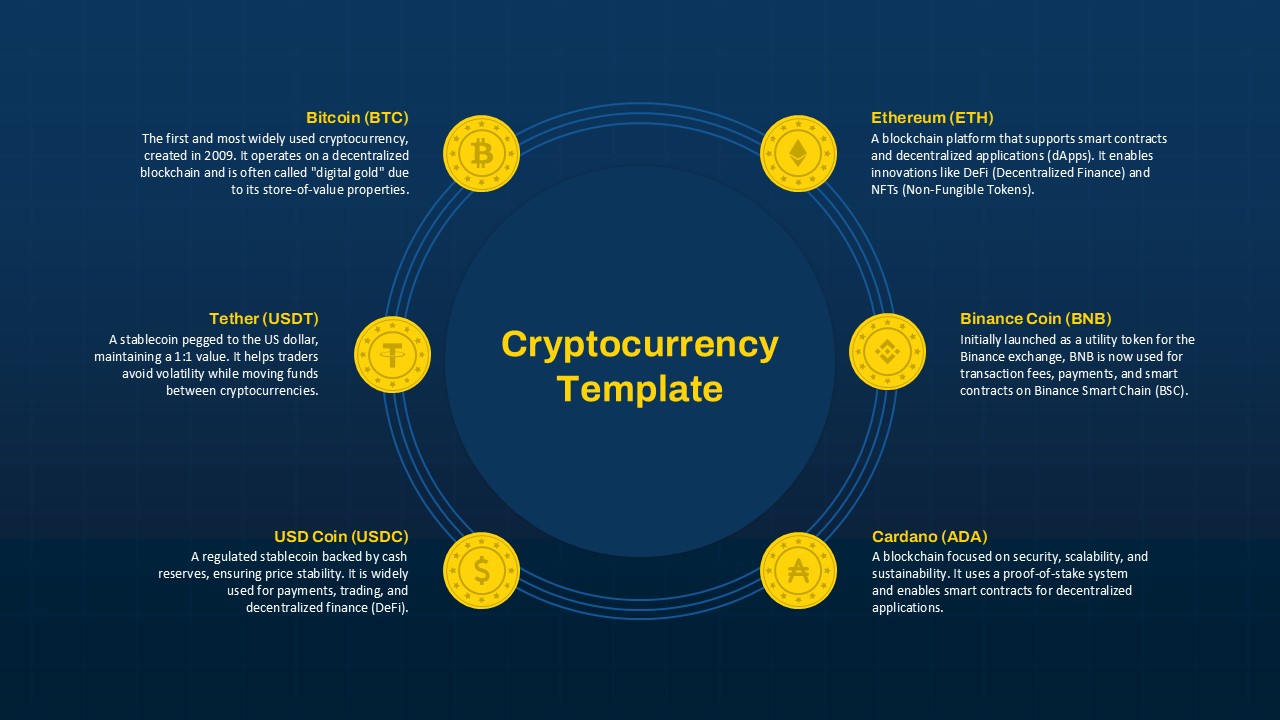

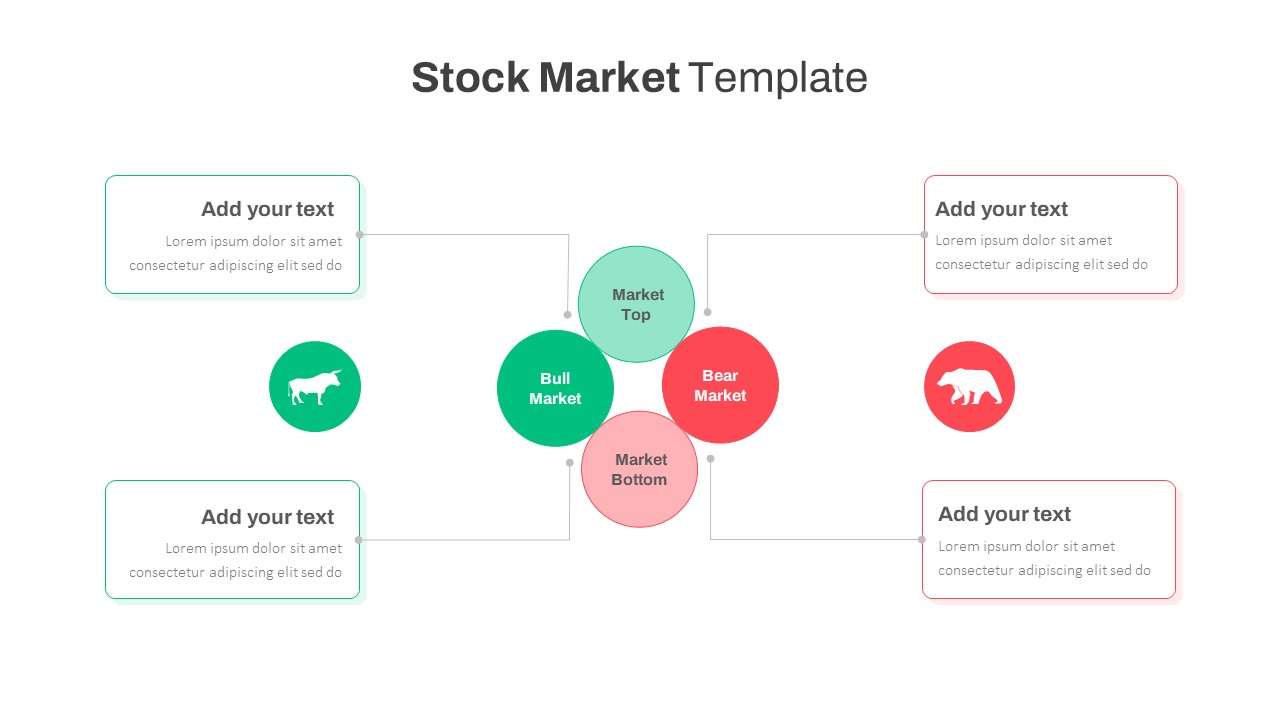

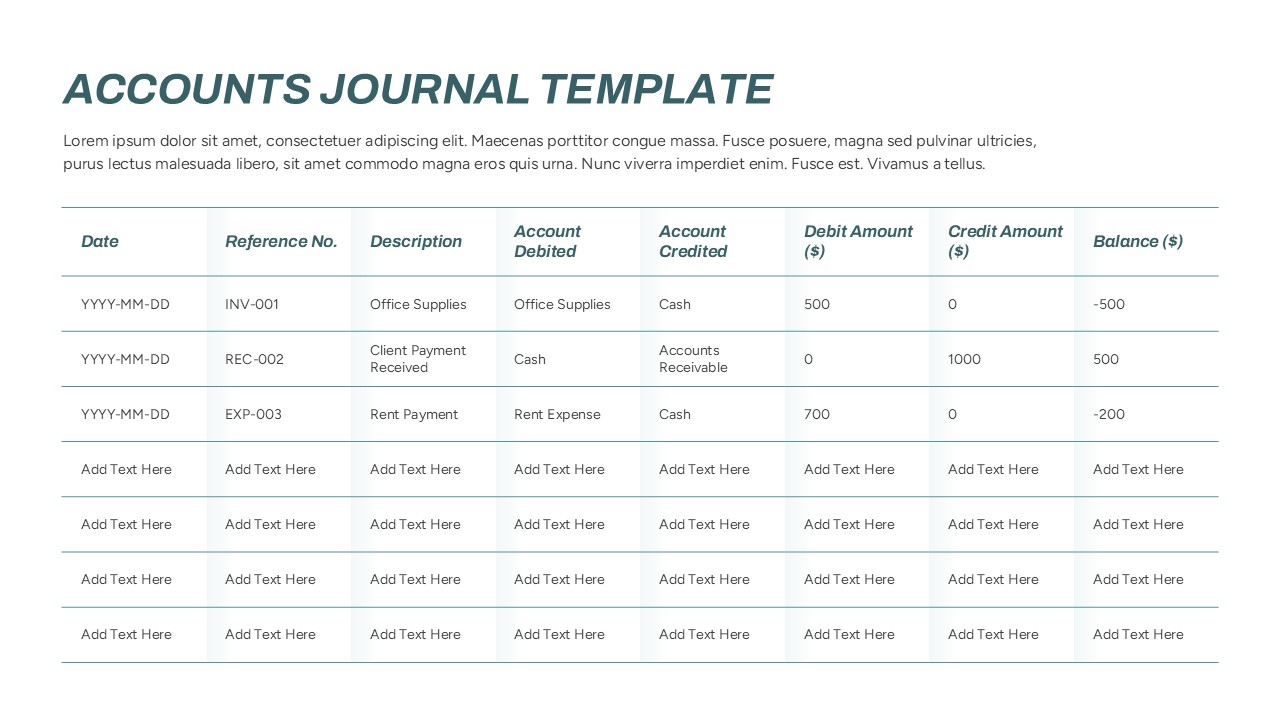

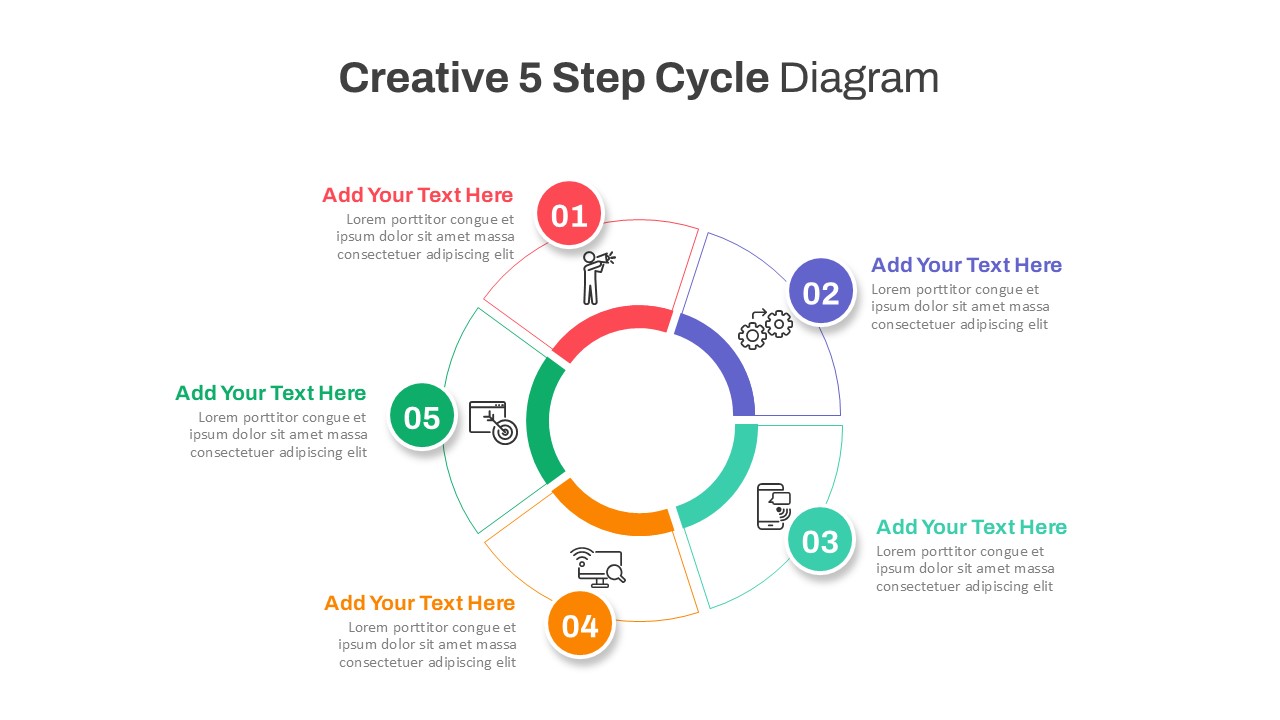

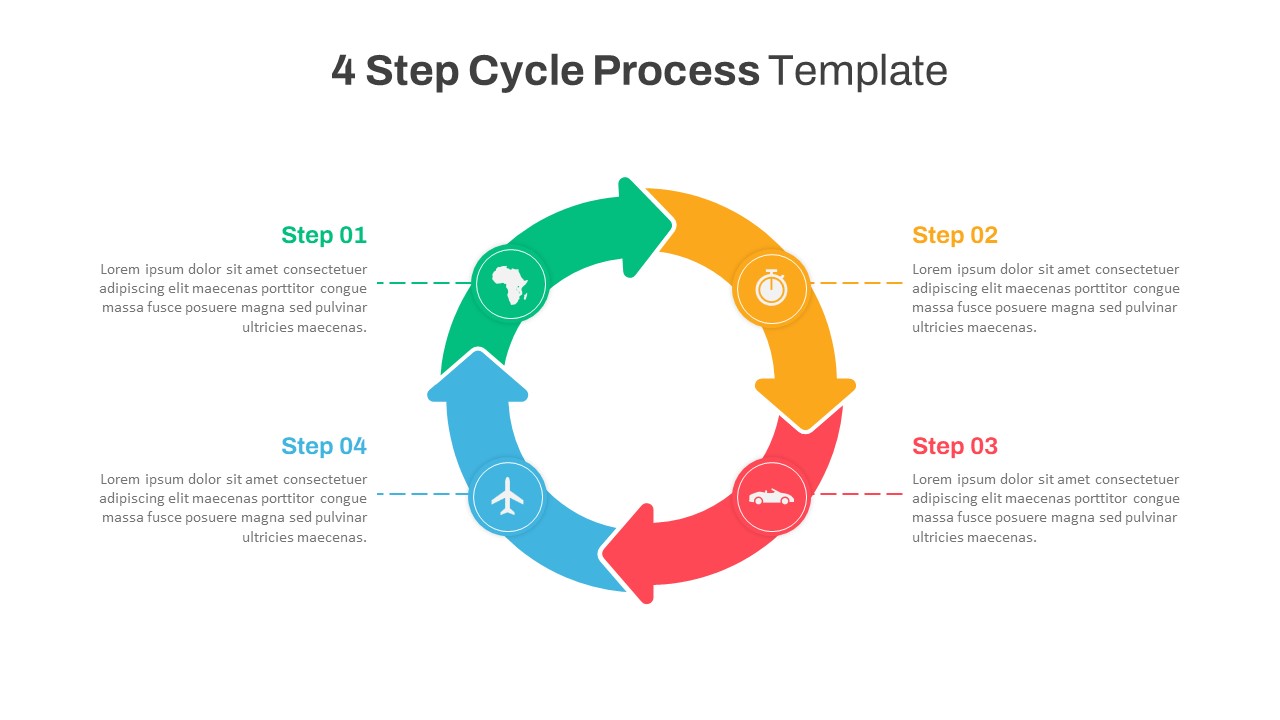

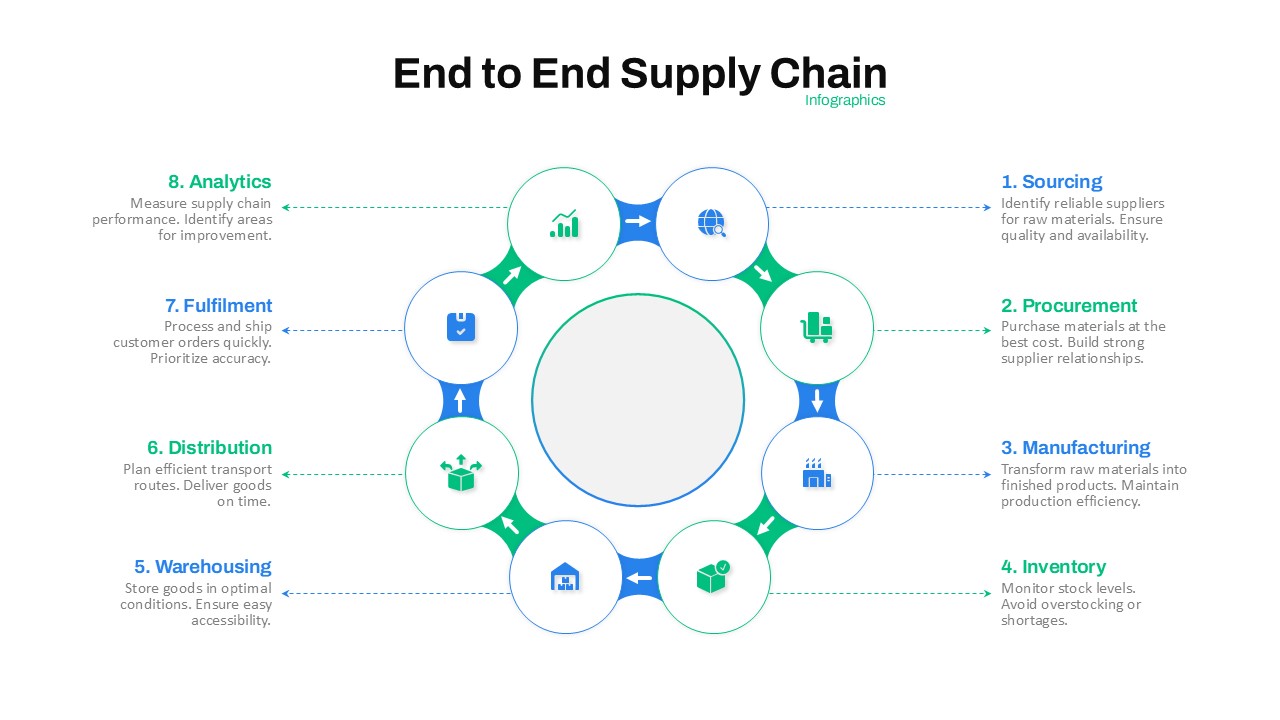

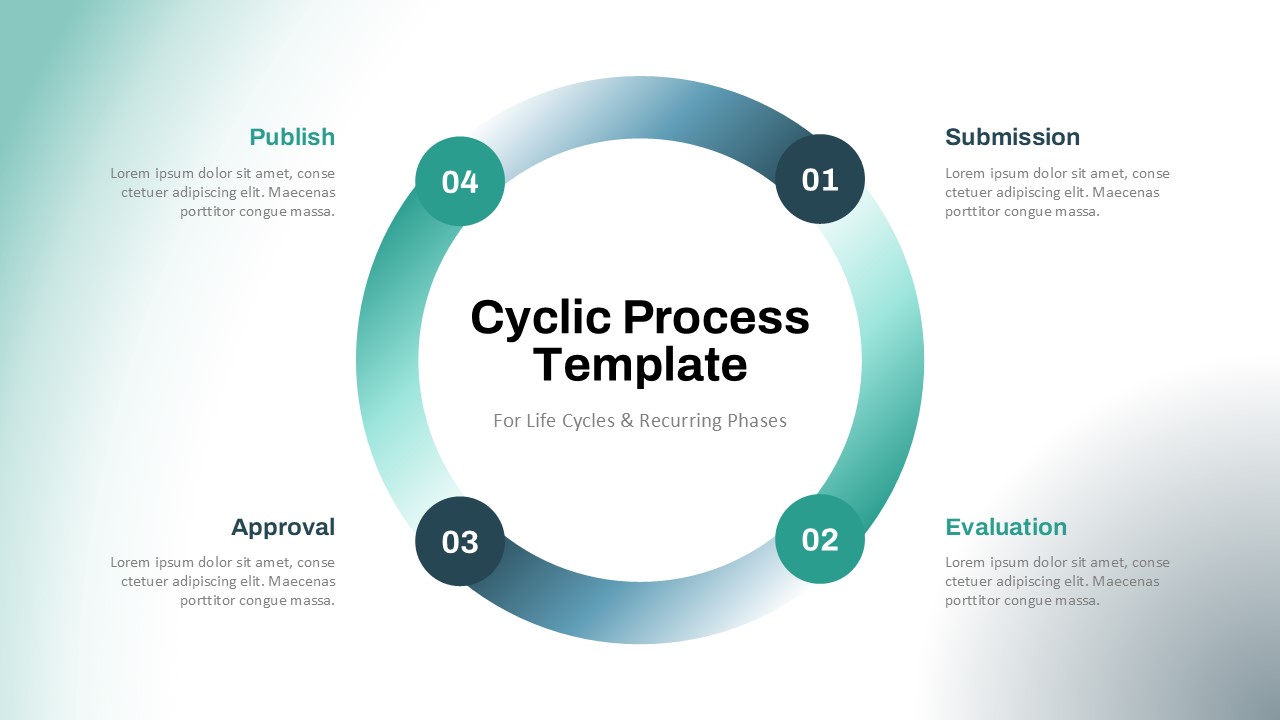

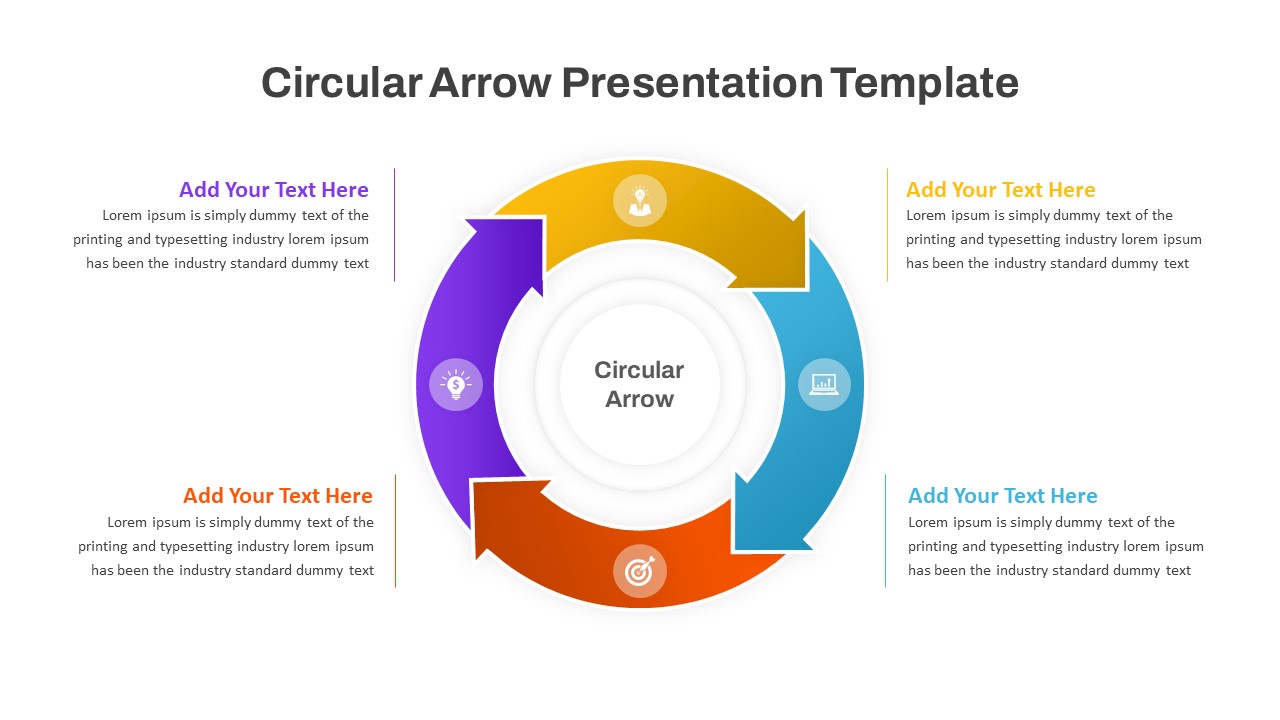

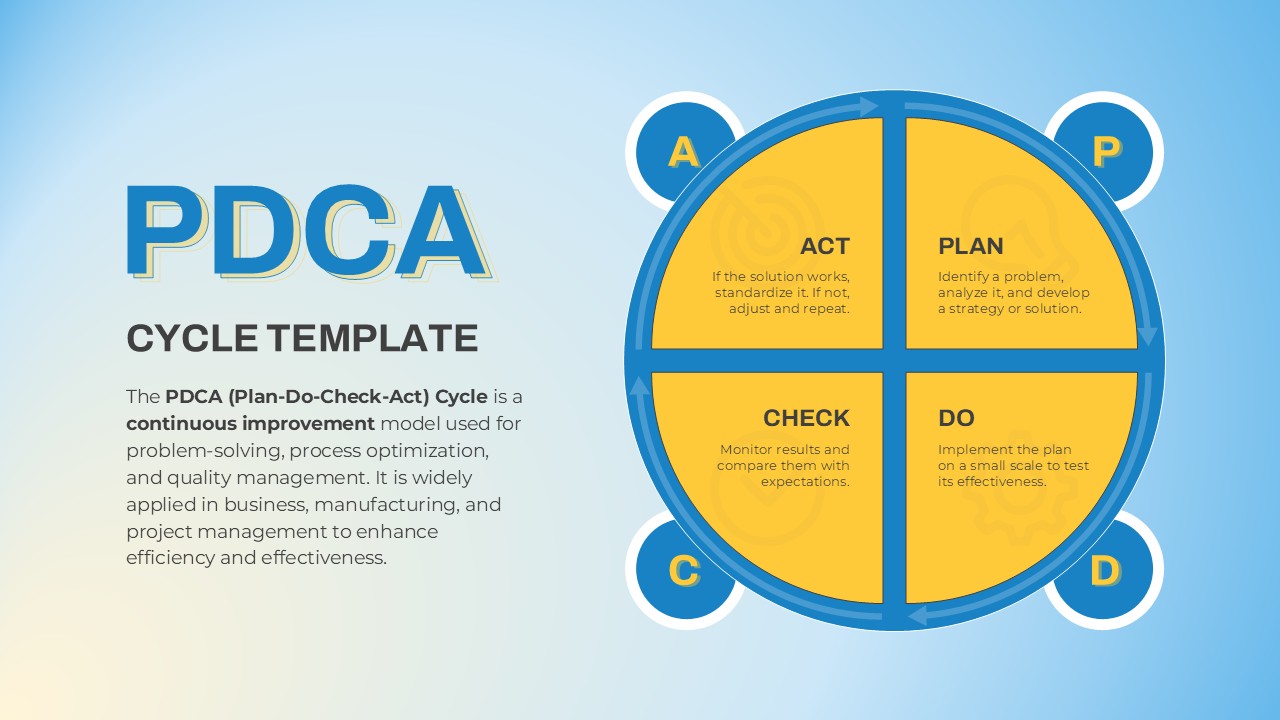

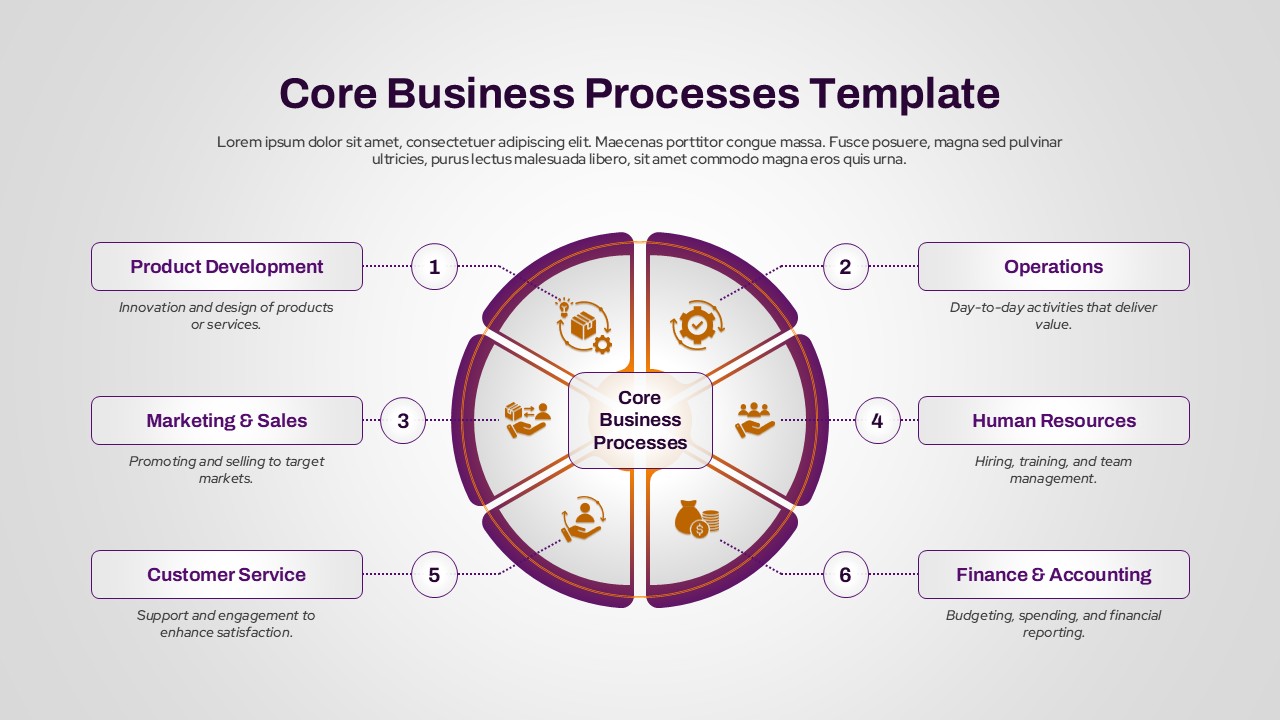

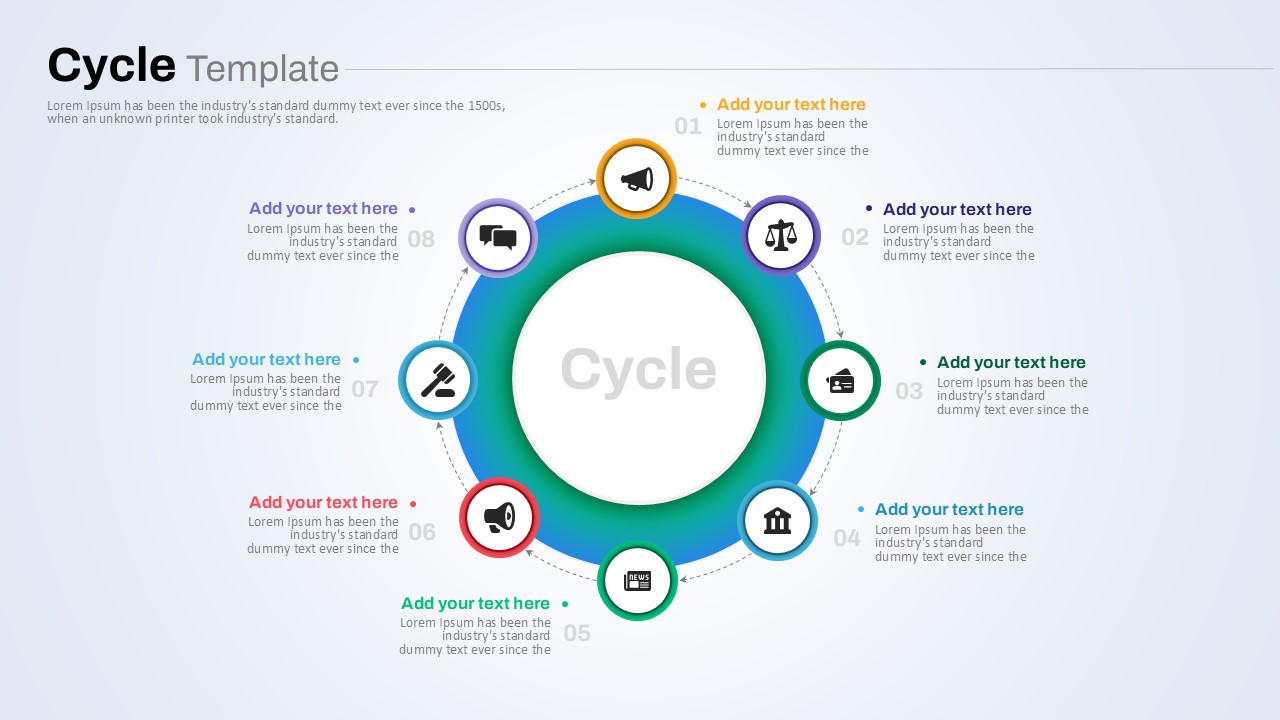

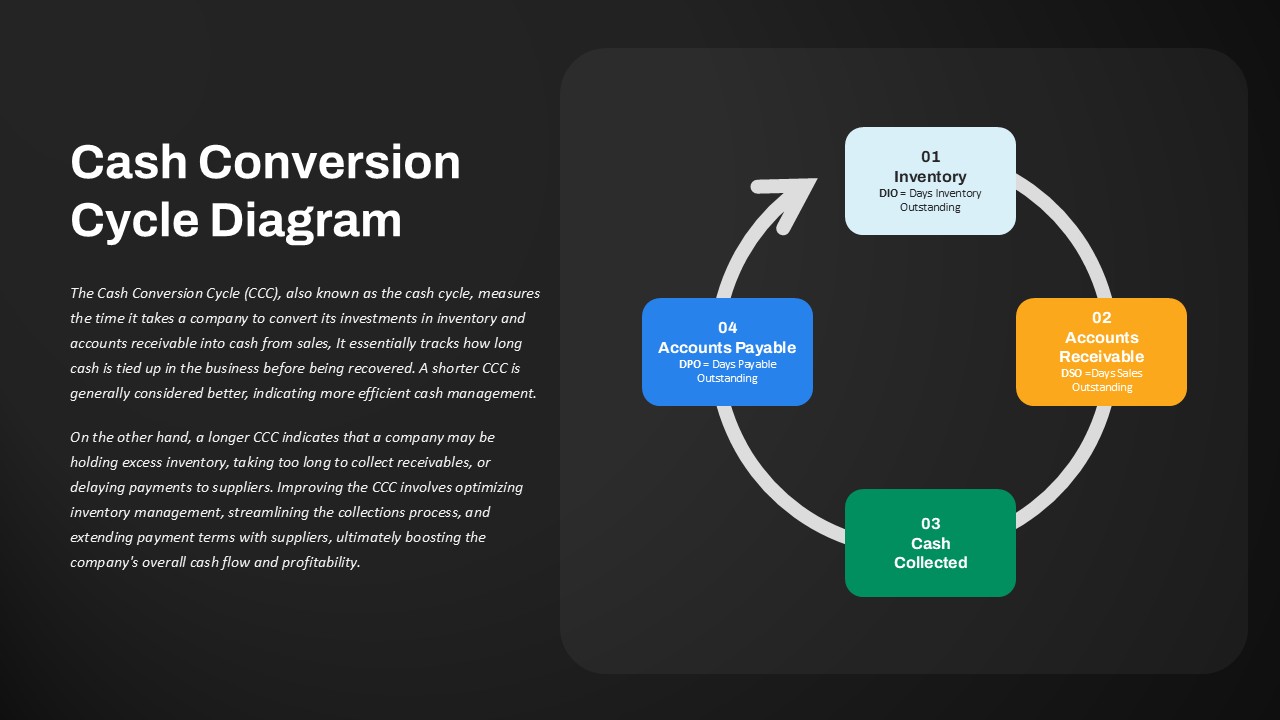

The circular diagram clearly illustrates the four key components of the CCC: Inventory (DIO), Accounts Receivable (DSO), Cash Collected, and Accounts Payable (DPO). This intuitive flow visually represents how cash moves through a business—from purchasing inventory to receiving payments from customers—before settling obligations to suppliers.

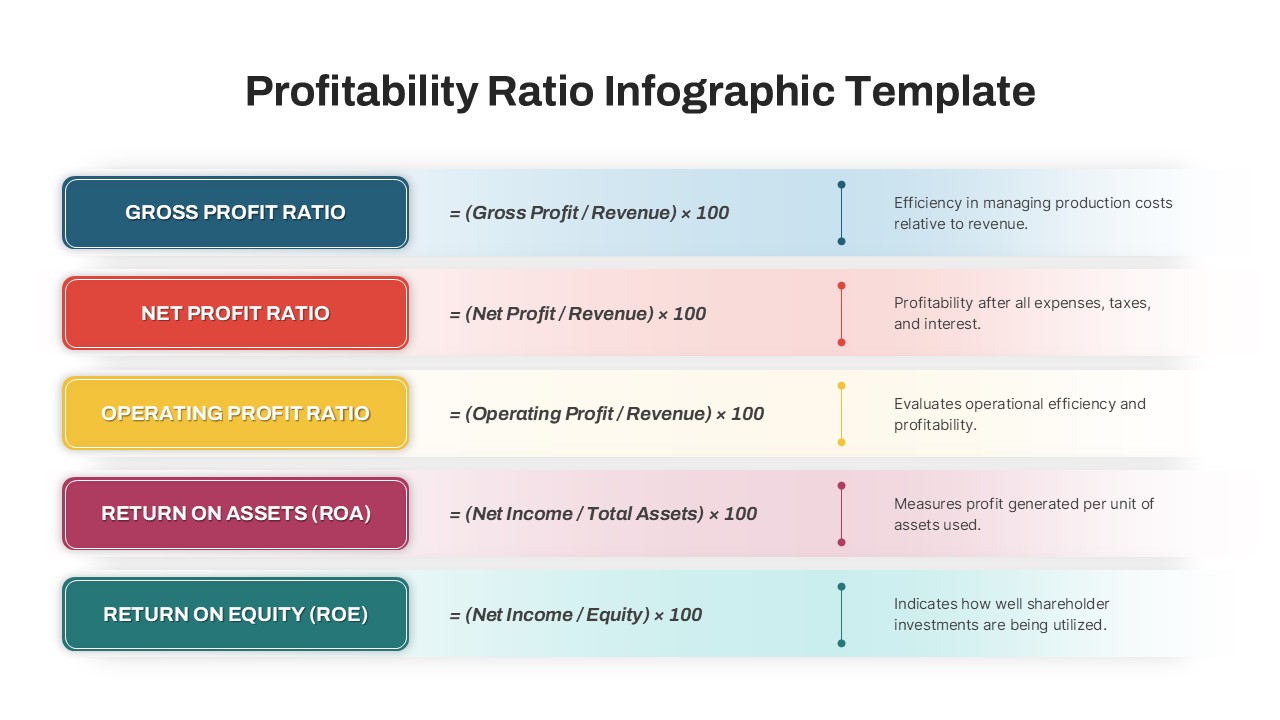

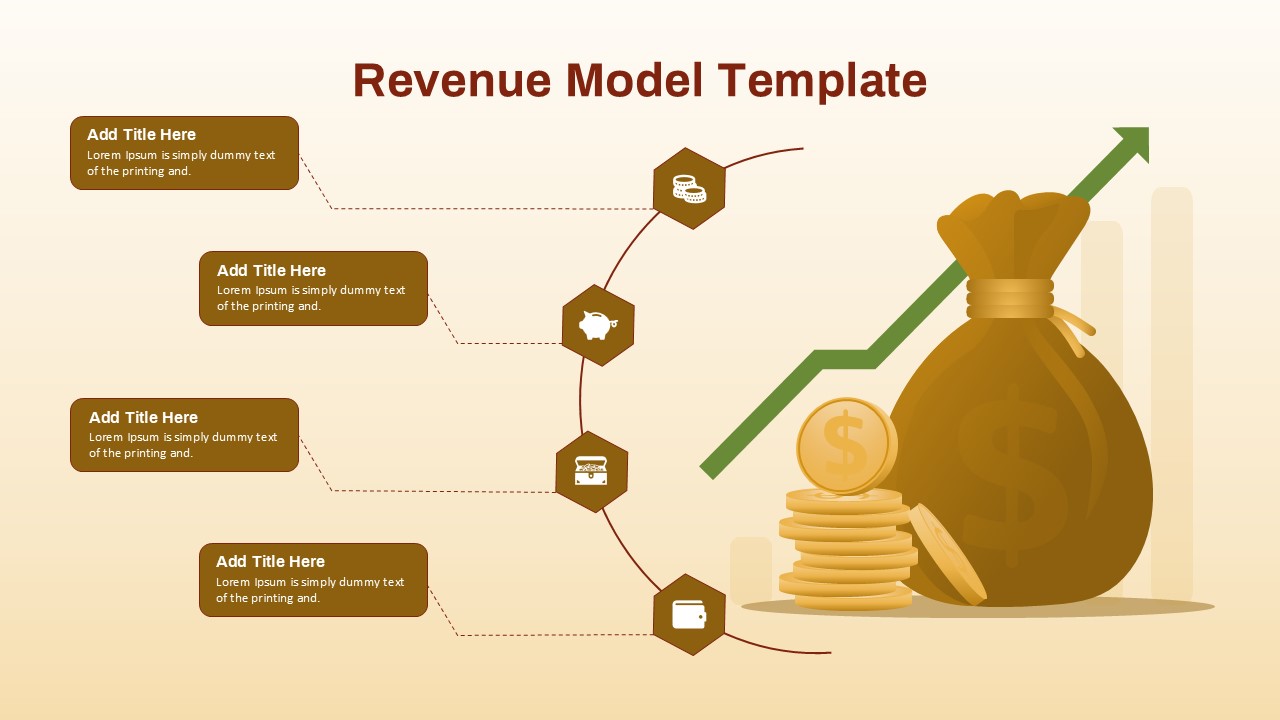

Alongside the diagram, a concise explanation outlines the importance of CCC as a key liquidity metric. A shorter cycle signals operational efficiency and better cash flow management, while a longer cycle may indicate inefficiencies in inventory turnover, collection delays, or supplier payment strategies.

Designed for both PowerPoint and Google Slides, the template is fully editable, enabling users to customize labels, colors, and text based on specific use cases or corporate data. It serves as a valuable tool for internal finance briefings, strategic planning meetings, investor presentations, or academic instruction.

Whether you’re explaining financial KPIs to stakeholders or evaluating a company’s working capital efficiency, this CCC diagram template provides clarity and impact through clean, visual storytelling.

See more

Features of this template

Other User Cases of the Template

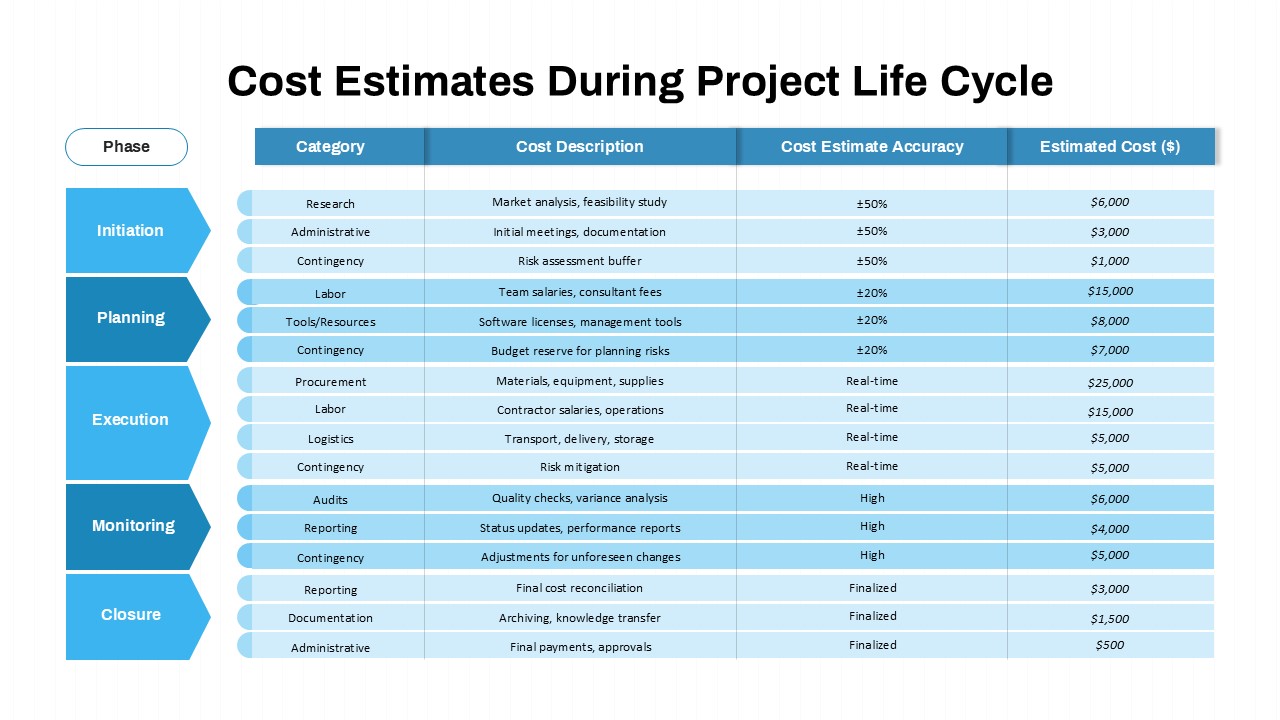

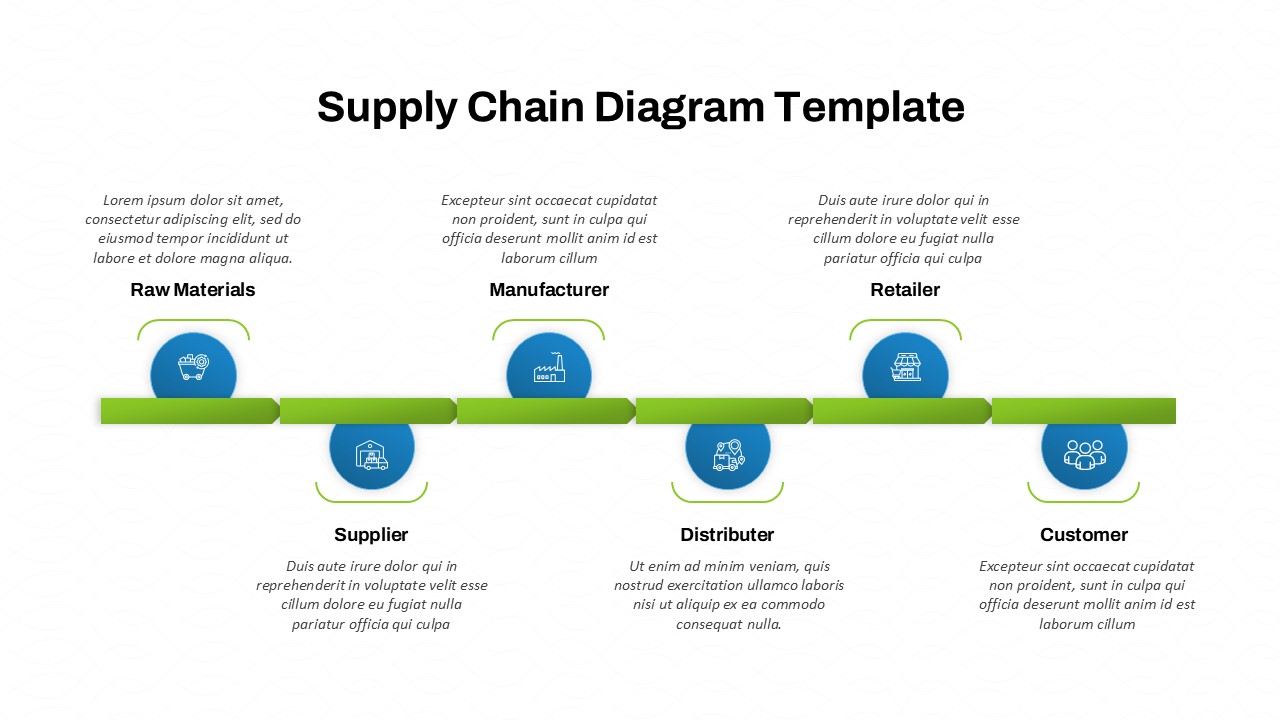

Financial performance presentations, Working capital analysis, Investor pitch decks, CFO quarterly reviews, Business school lectures, Cash flow optimization planning, Corporate finance training, Budget and forecast discussions, Internal audit reports, Supply chain financial reviews