Mergers and Acquisitions PowerPoint Presentation Templates

Mergers and Acquisitions PowerPoint Presentation: A Comprehensive Slide Deck

This Mergers and Acquisitions PowerPoint Presentation is a well-structured slide deck designed to simplify and organize M&A planning. Whether used for educational instruction or professional boardroom discussions, this presentation offers a practical layout for explaining the key components of a merger or acquisition.

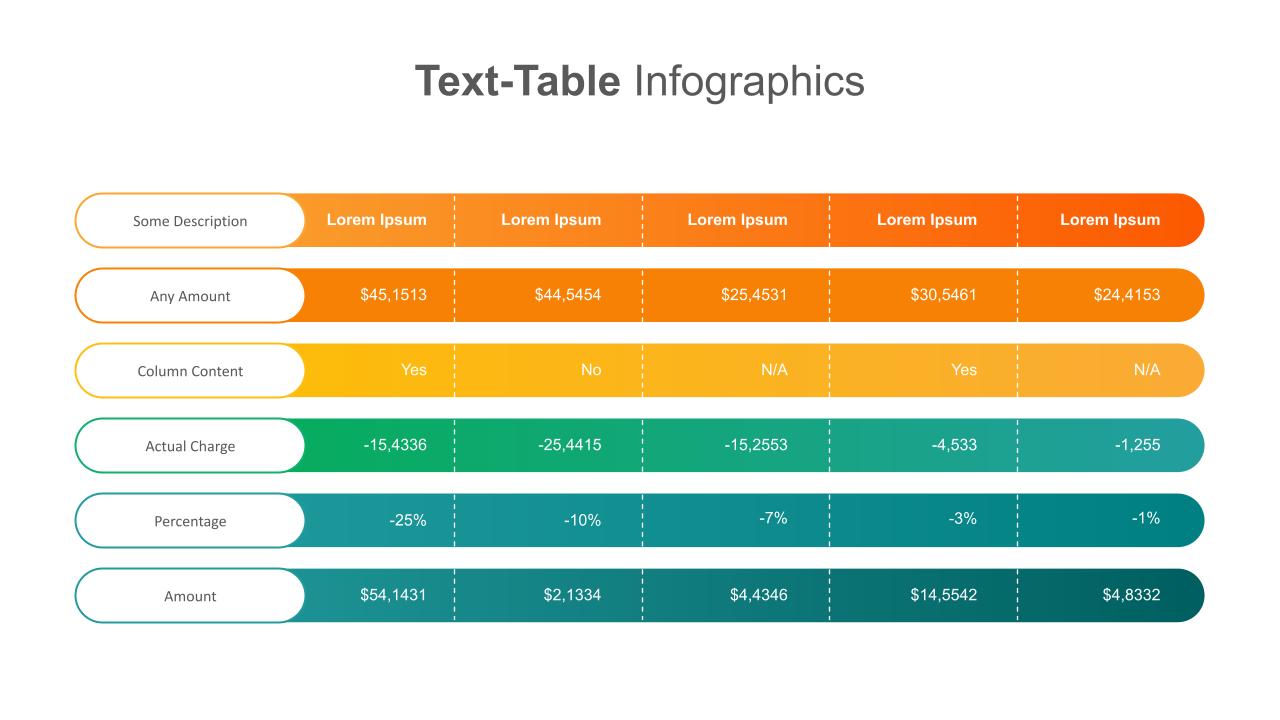

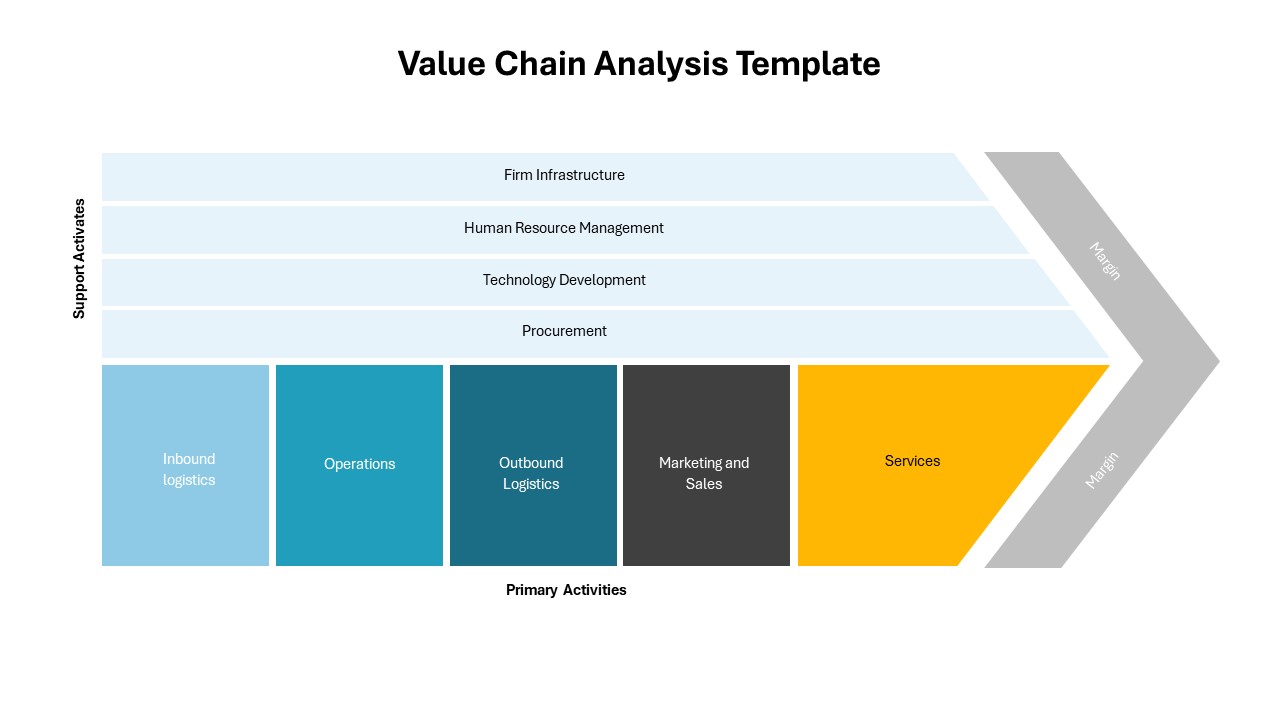

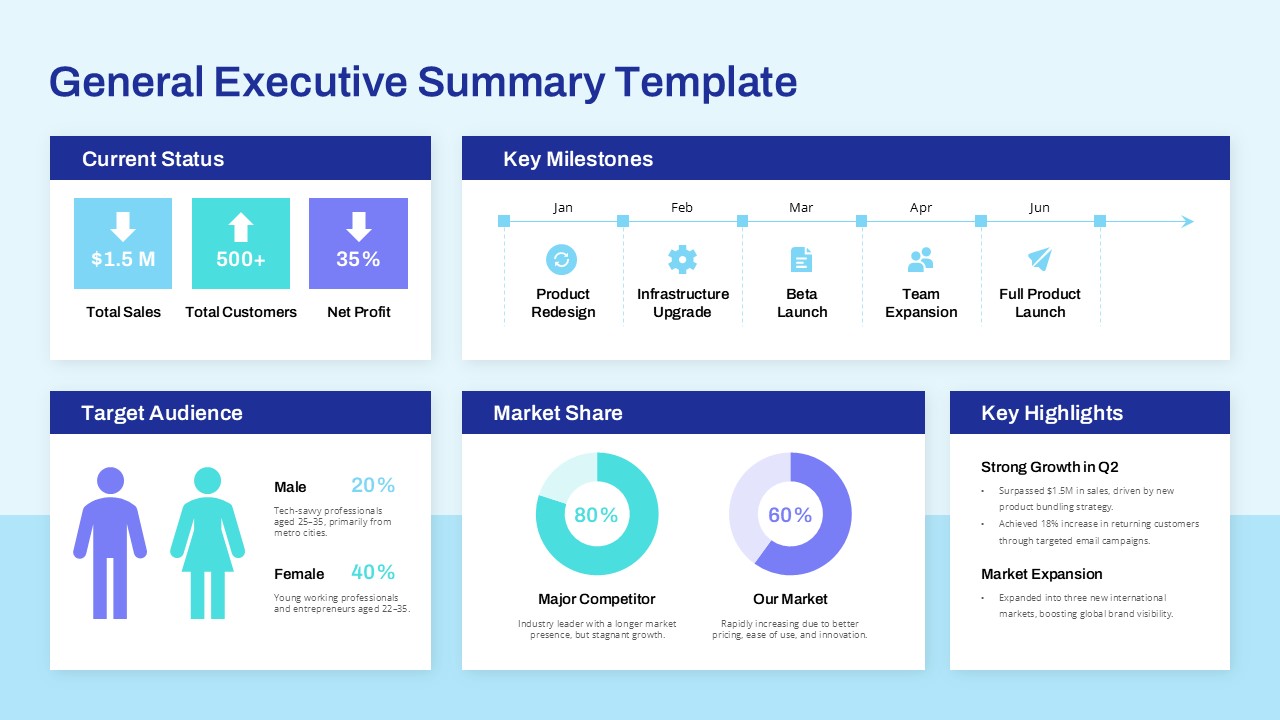

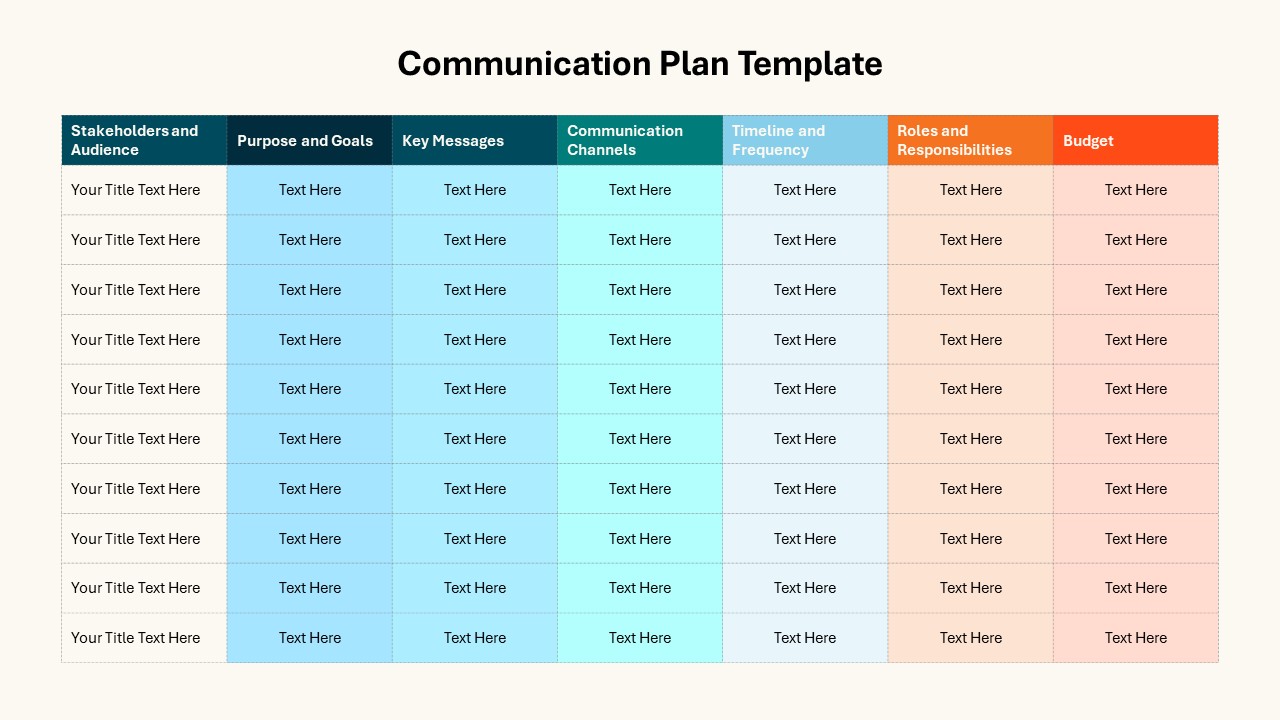

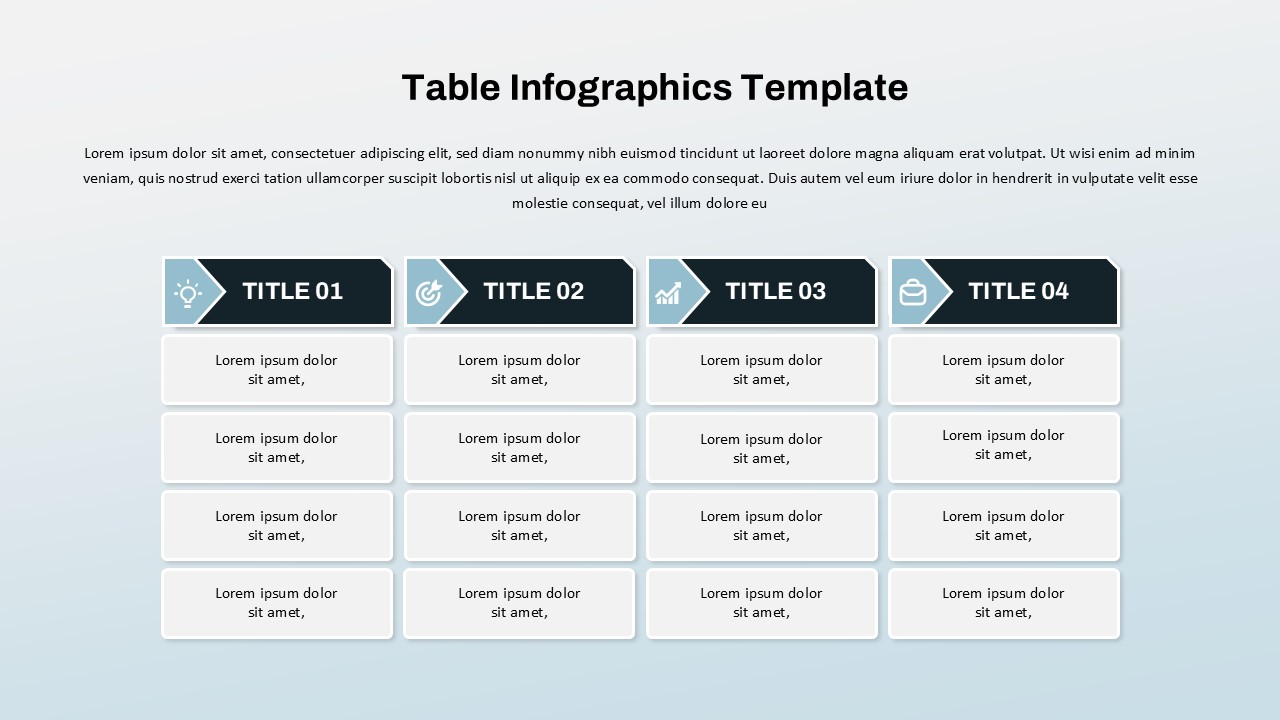

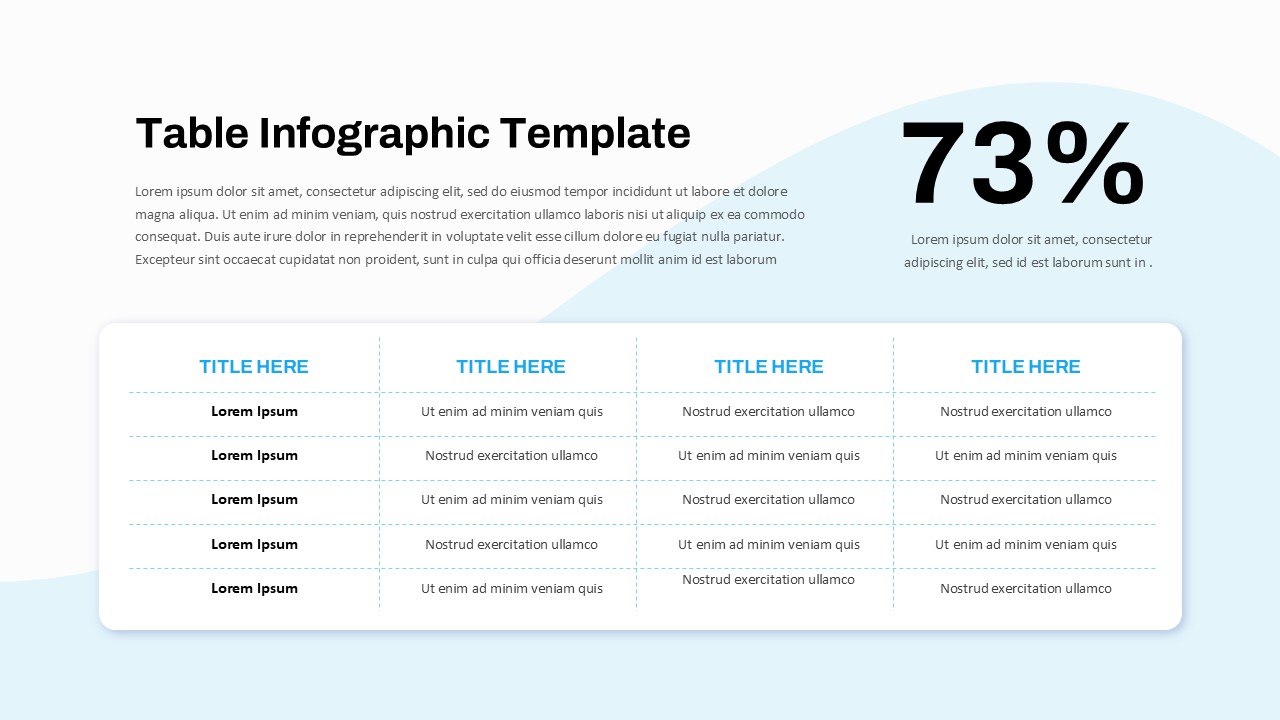

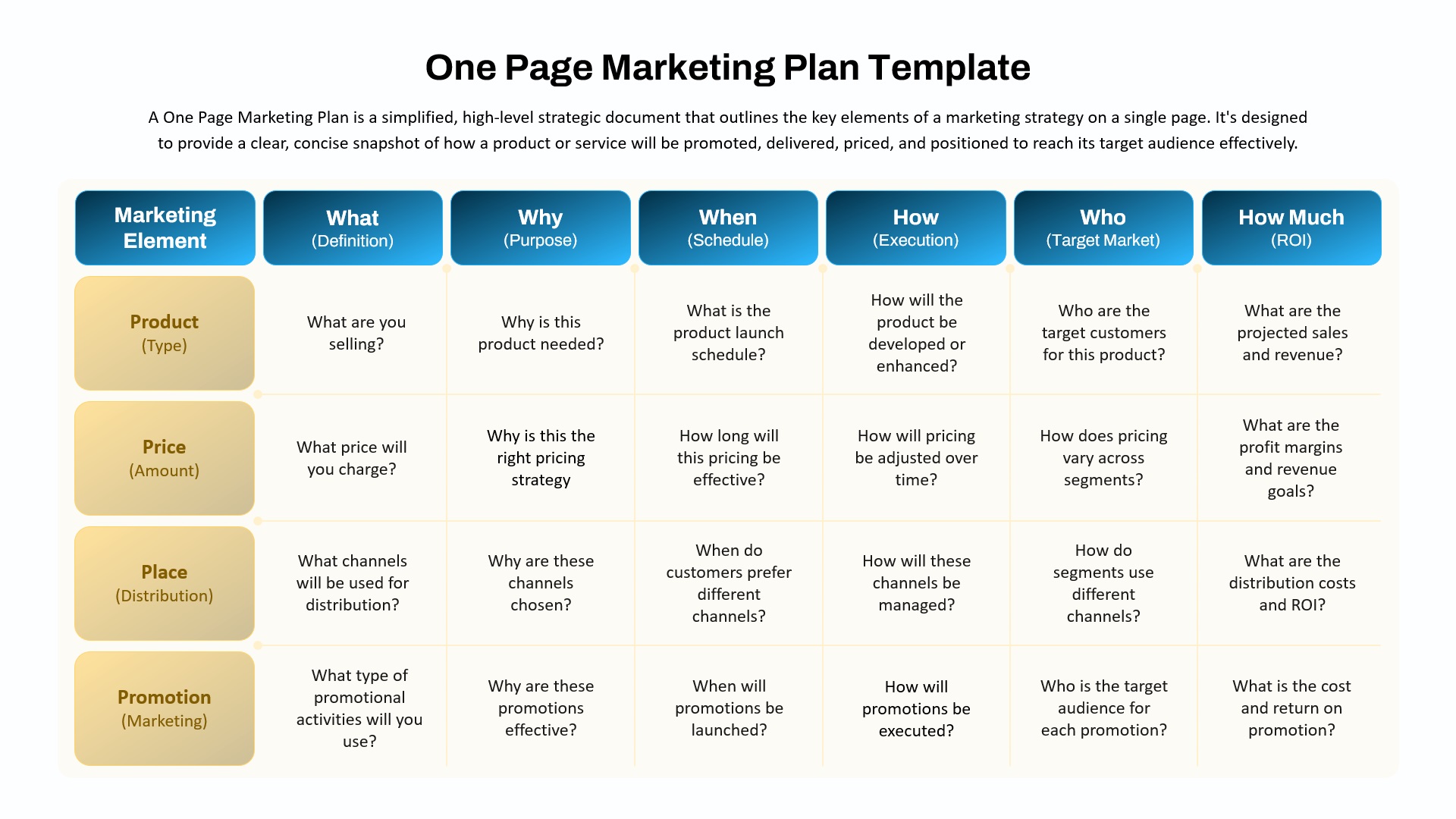

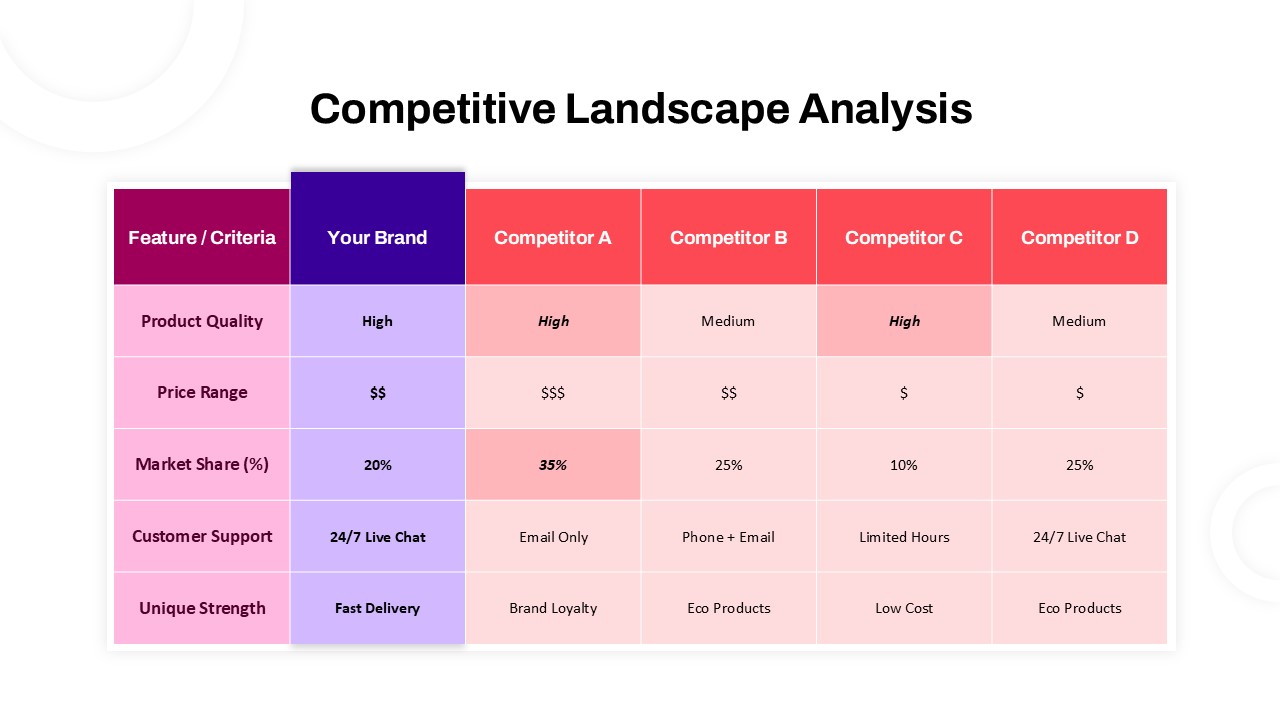

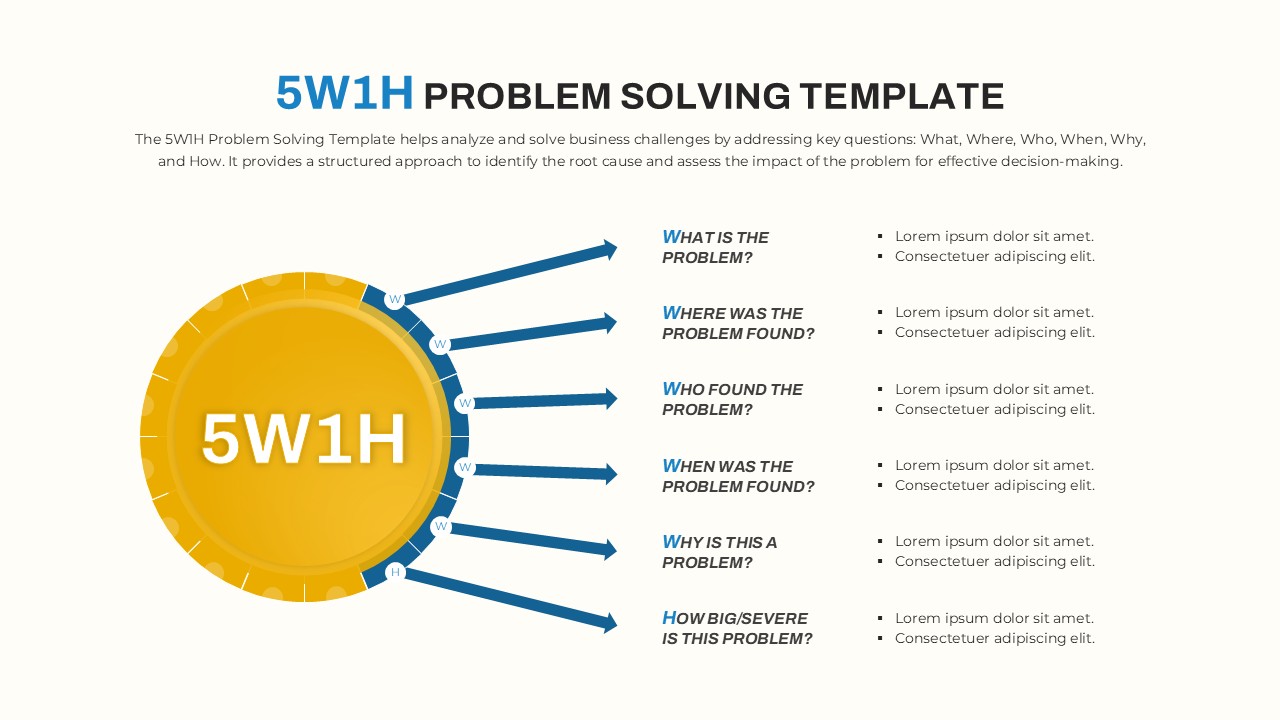

The slide deck includes a title slide, followed by an executive summary outlining the proposal and key highlights. One of the essential elements is the Company A and Company B comparison table, which highlights the characteristics and strengths of the merging entities. These visuals are critical for helping stakeholders quickly understand compatibility and strategic alignment.

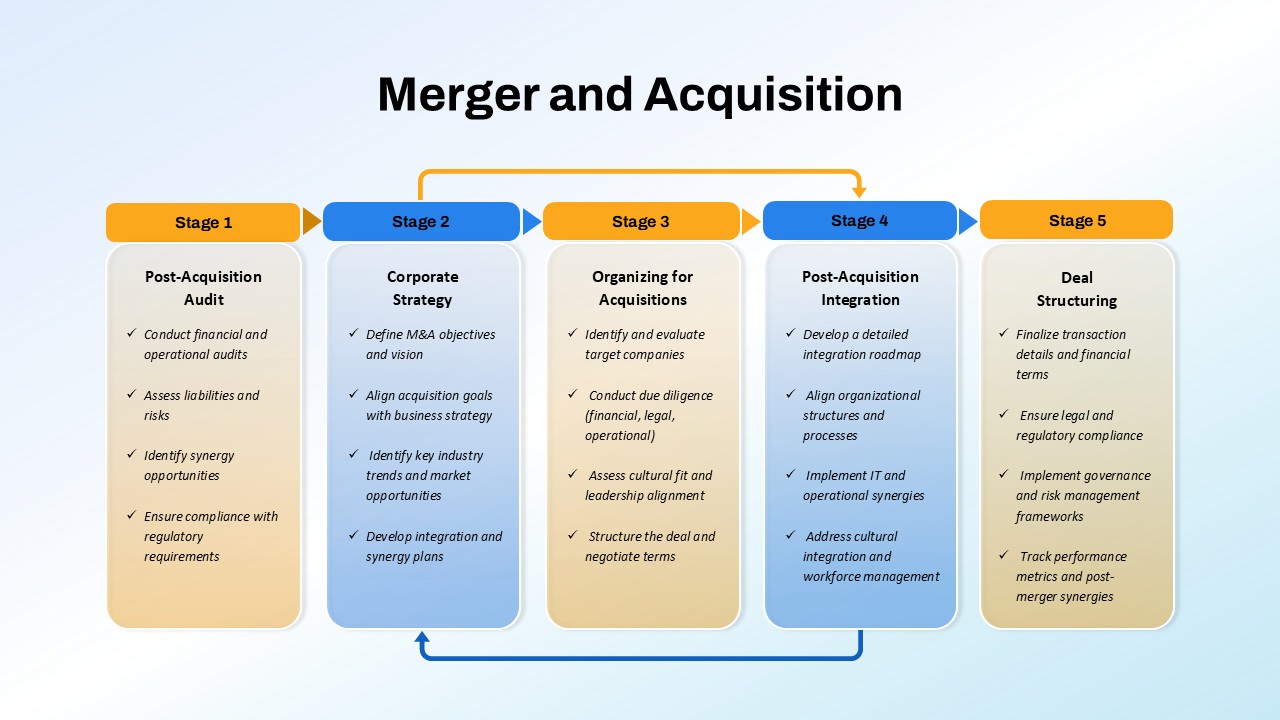

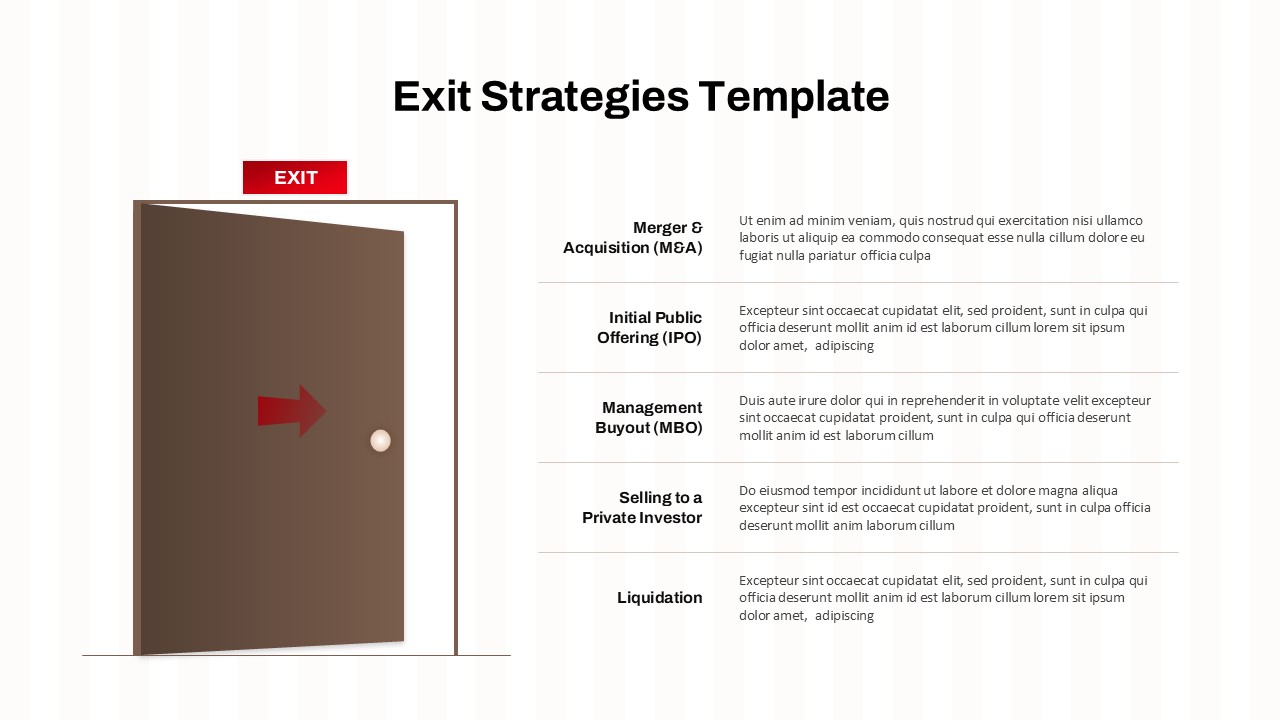

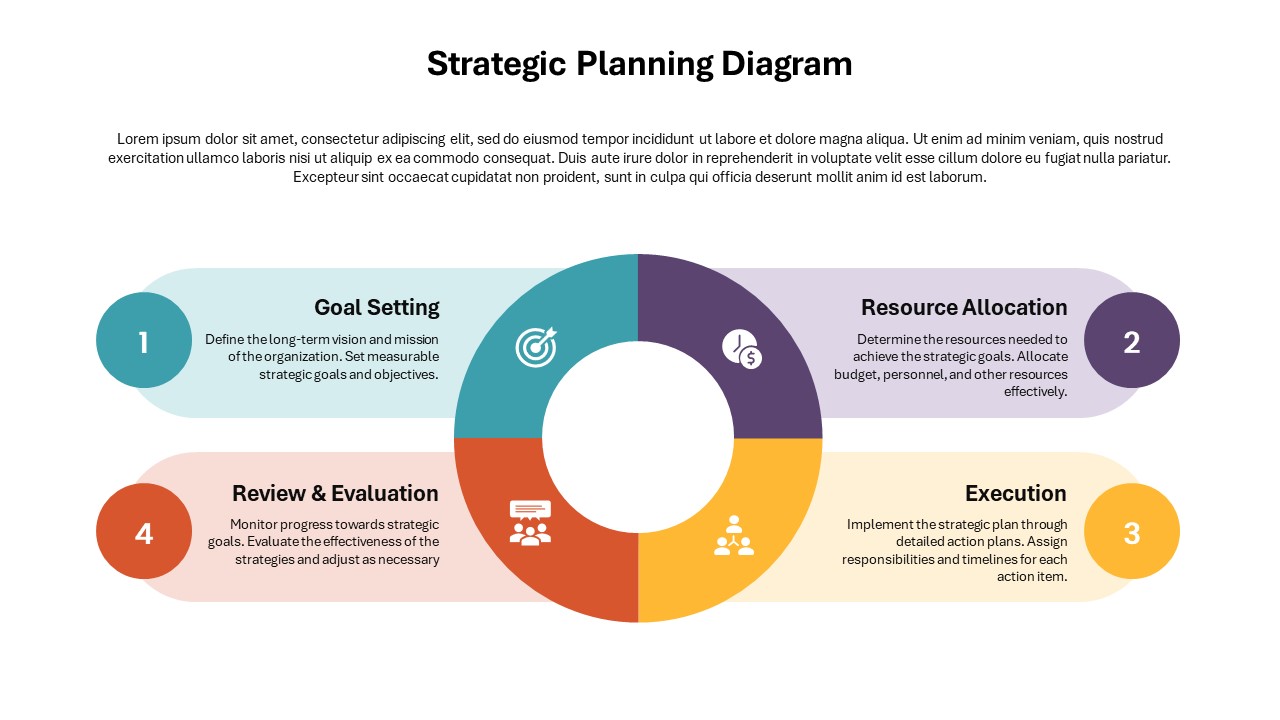

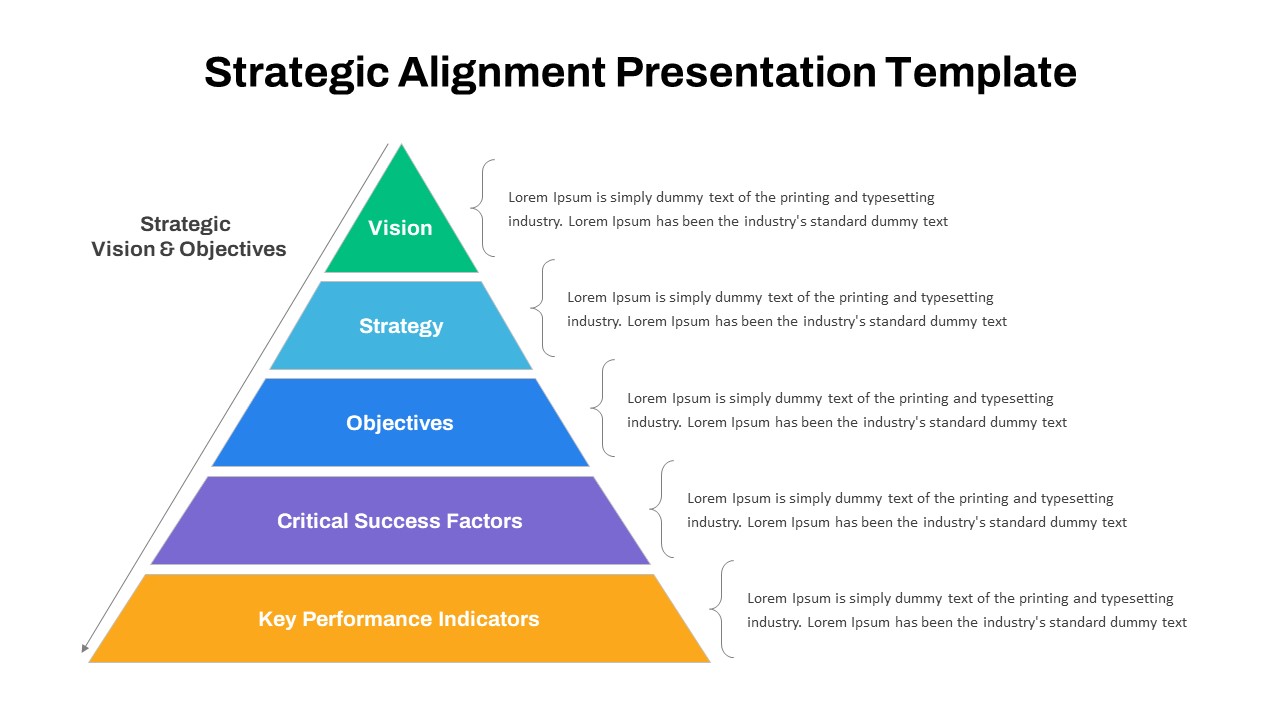

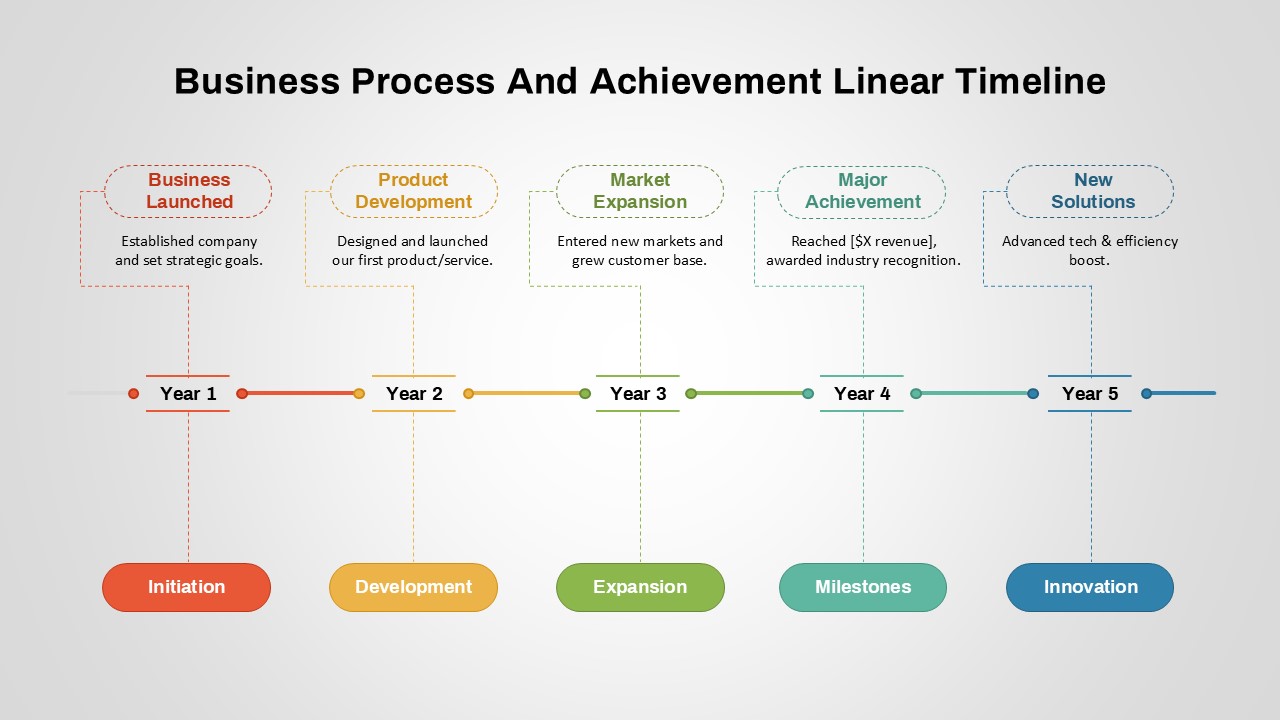

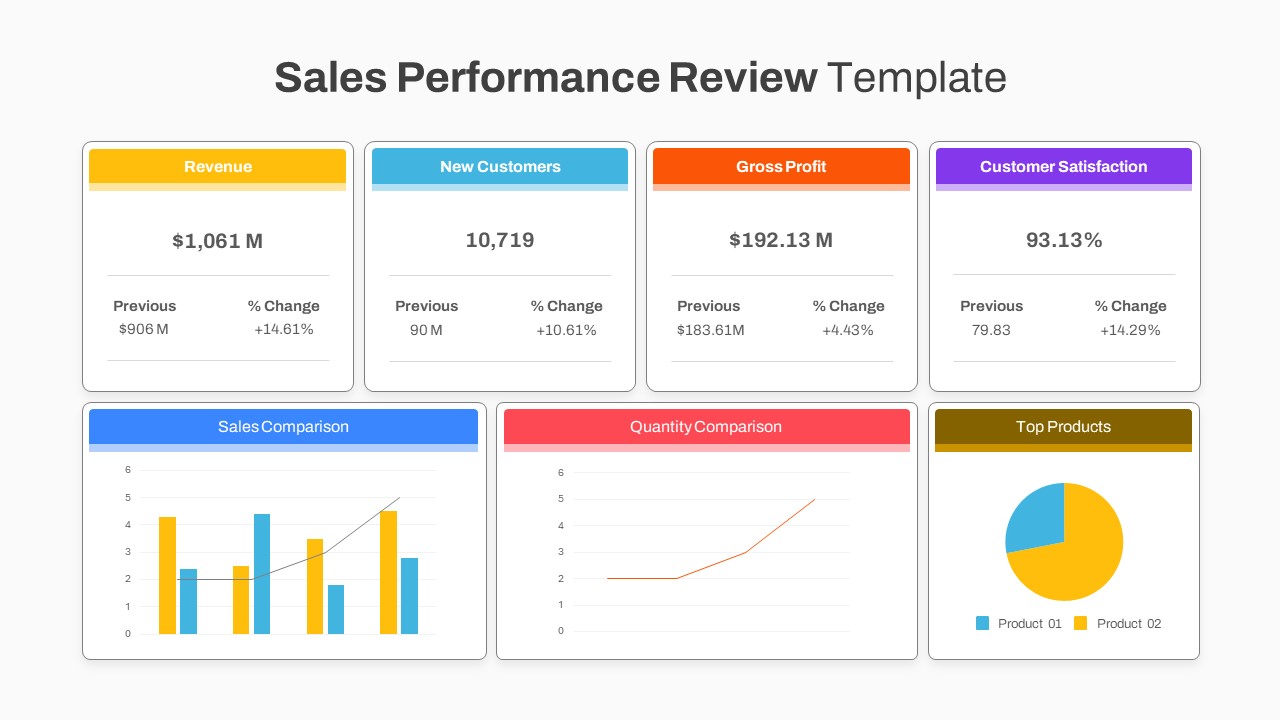

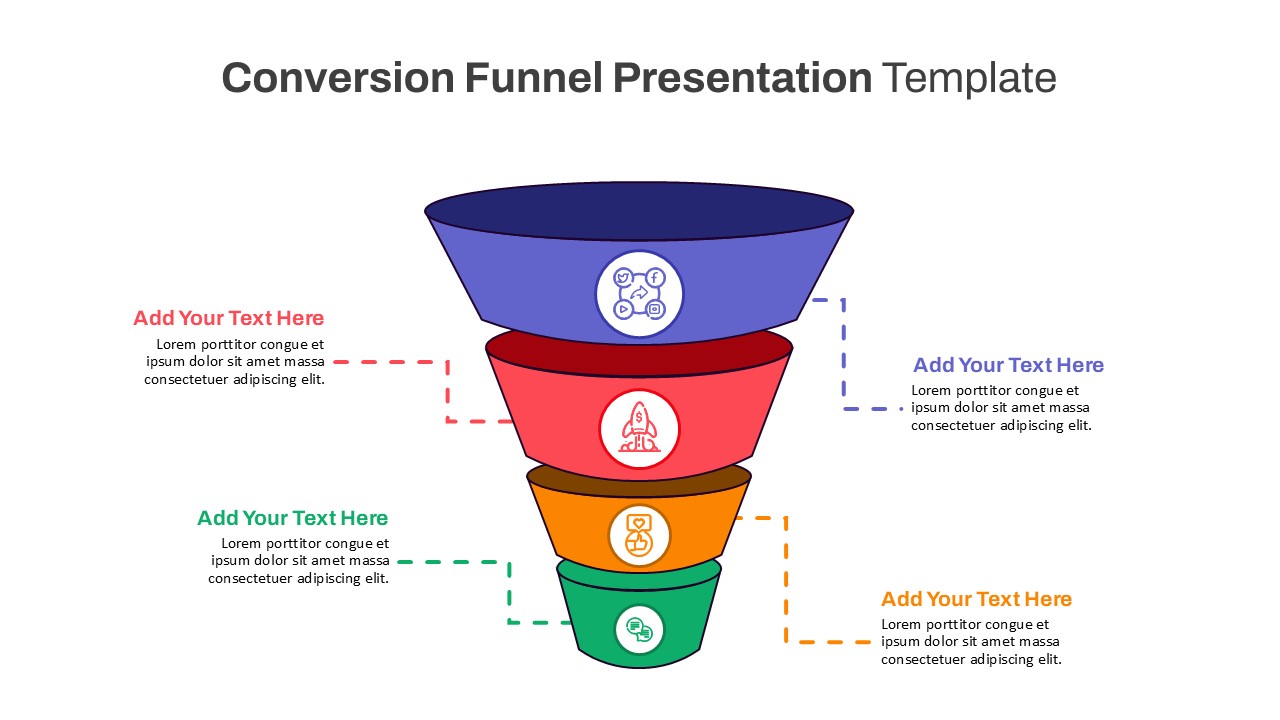

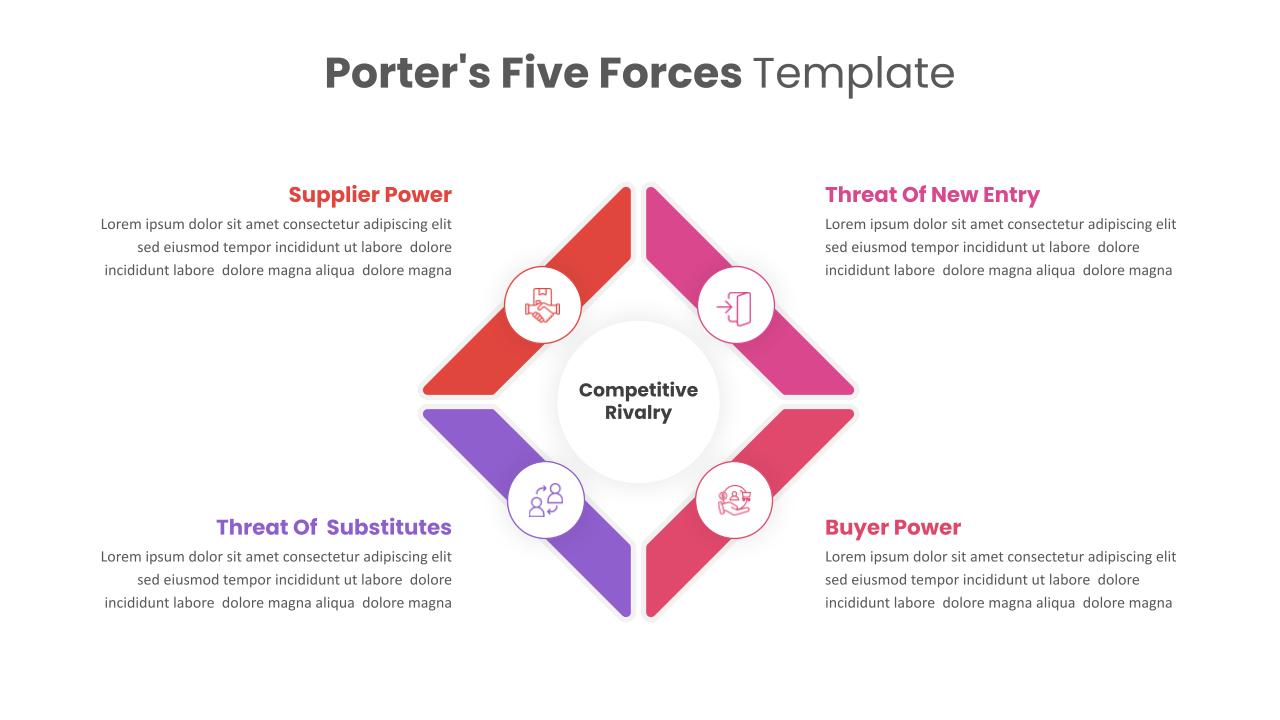

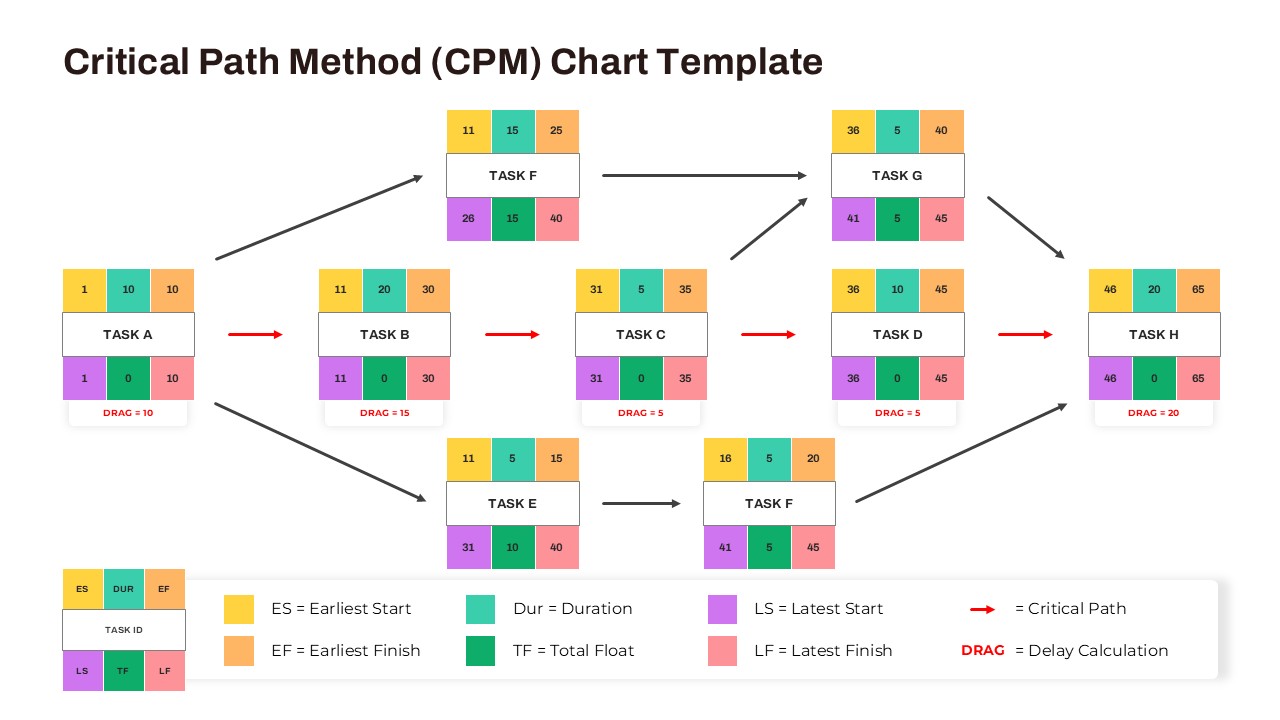

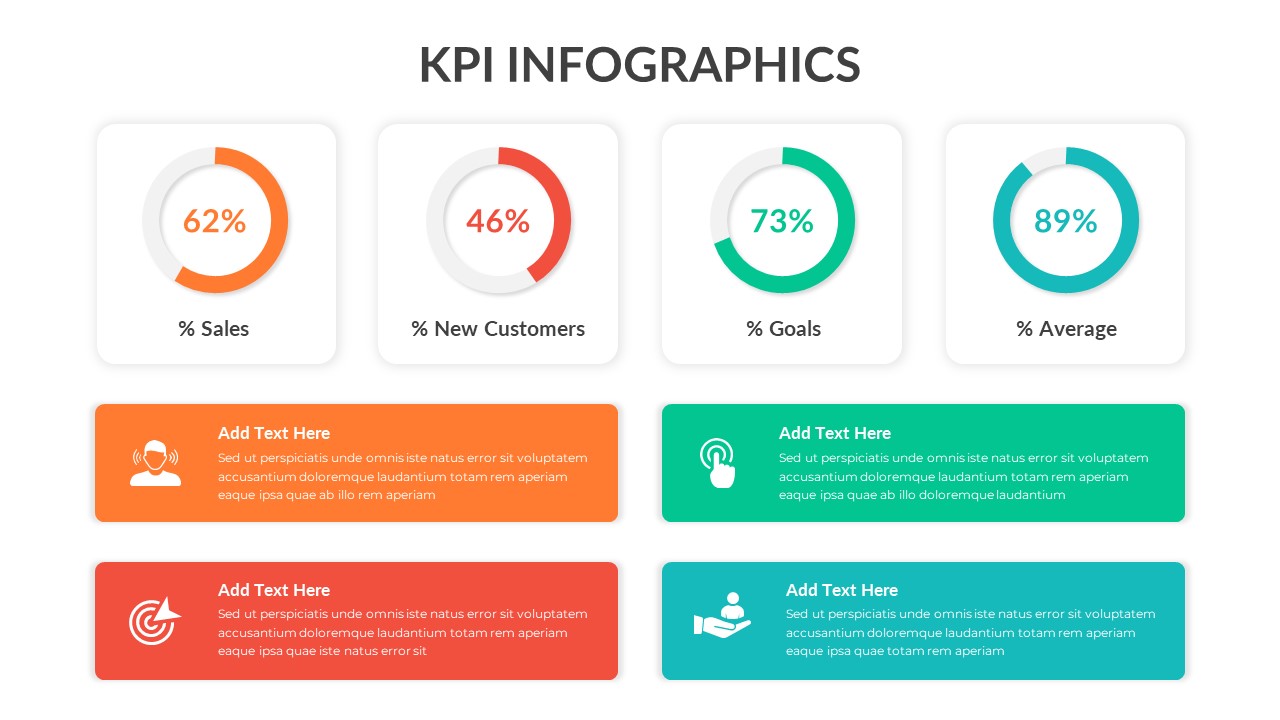

To strengthen the message, the strategic rationale slide uses six text boxes to present core reasons for the merger, while the deal structure template helps illustrate ownership changes, cash vs. stock deals, and other transaction elements. Financial data is clearly communicated through a bar chart and pie diagram showing financial highlights, allowing for visual interpretation of revenue, cost savings, and projected growth.

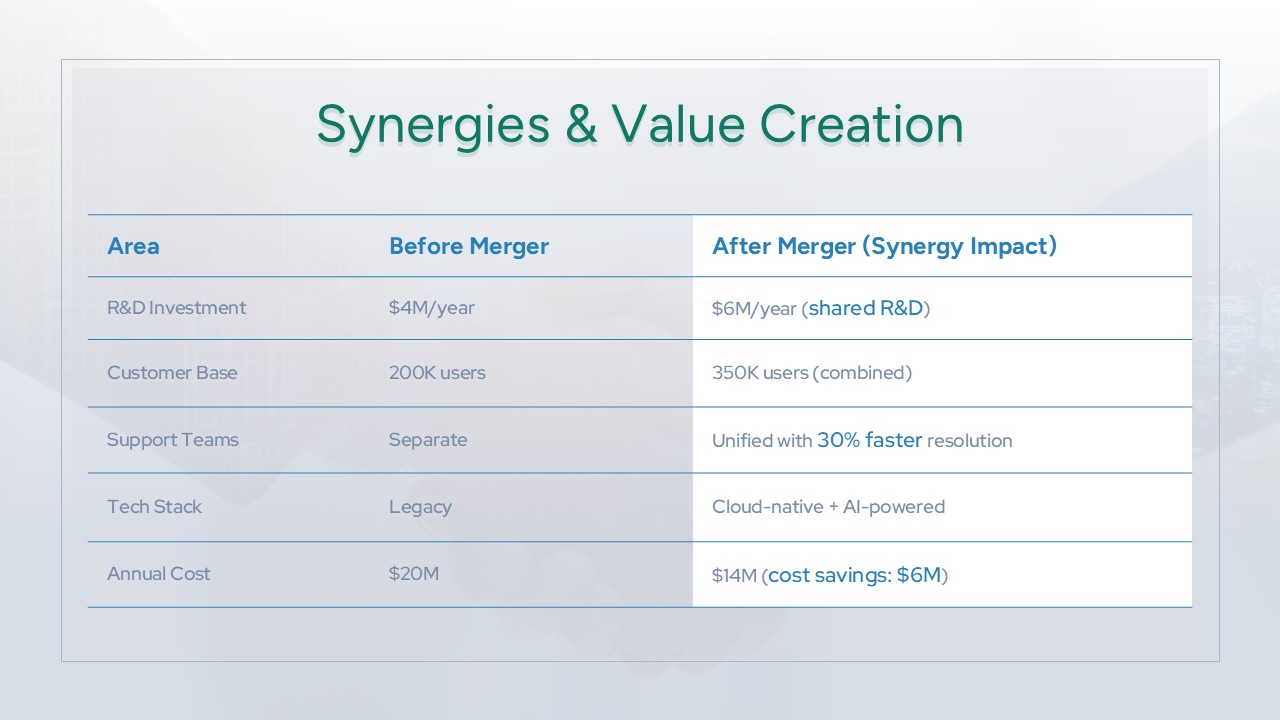

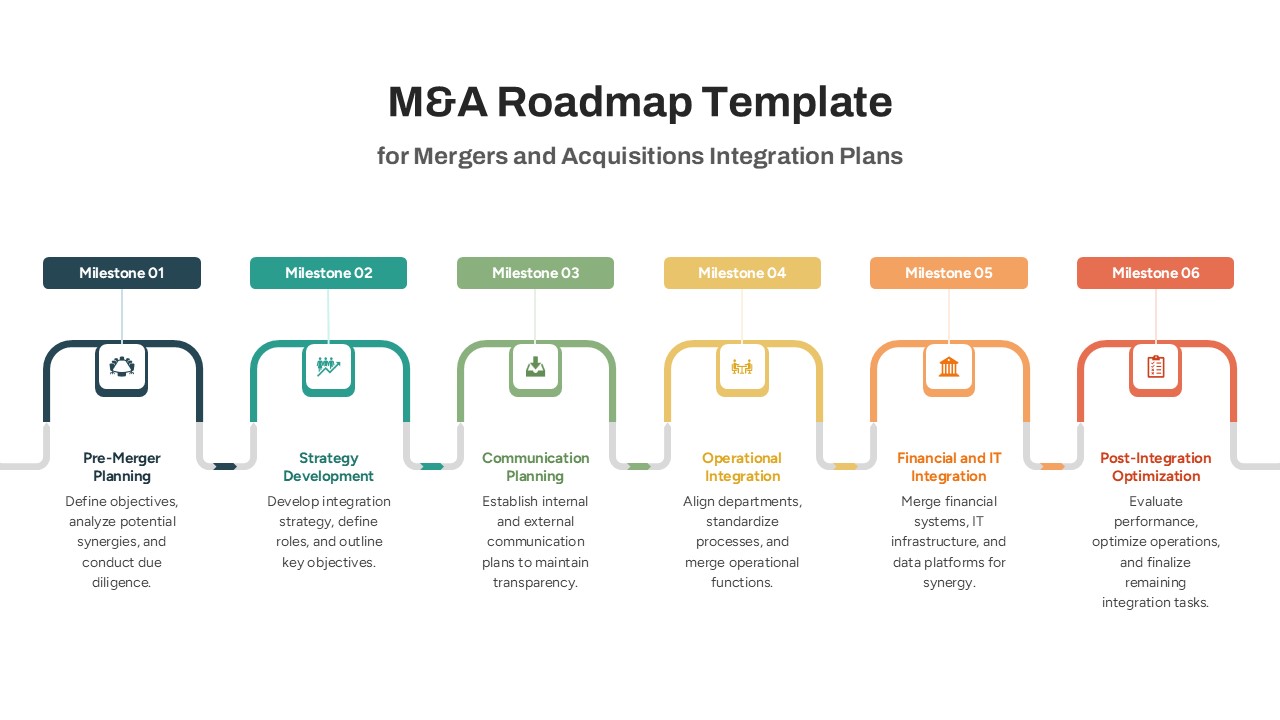

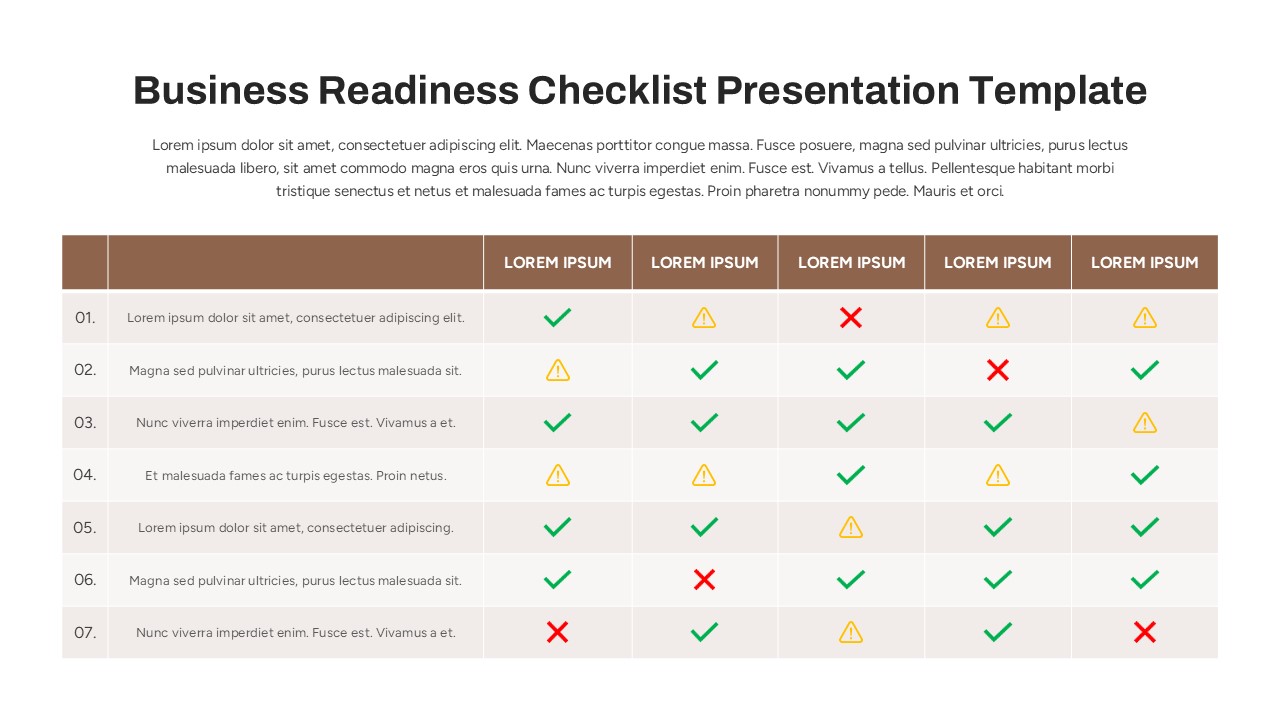

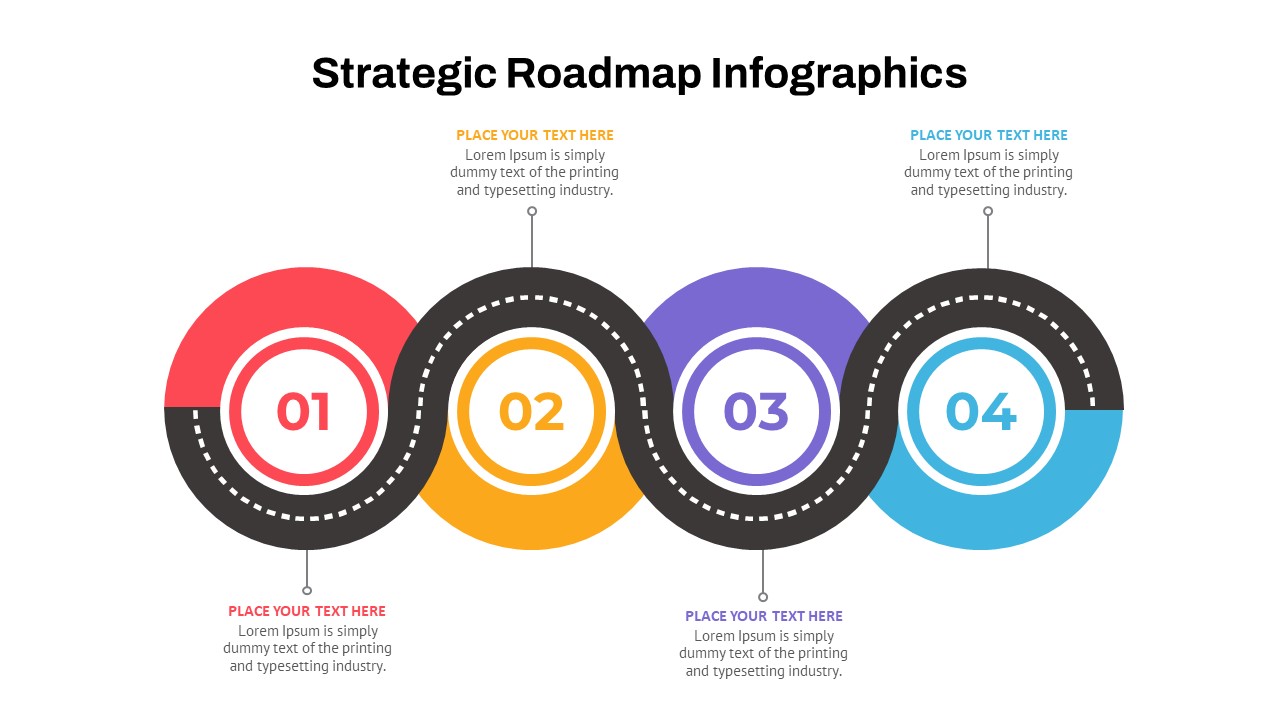

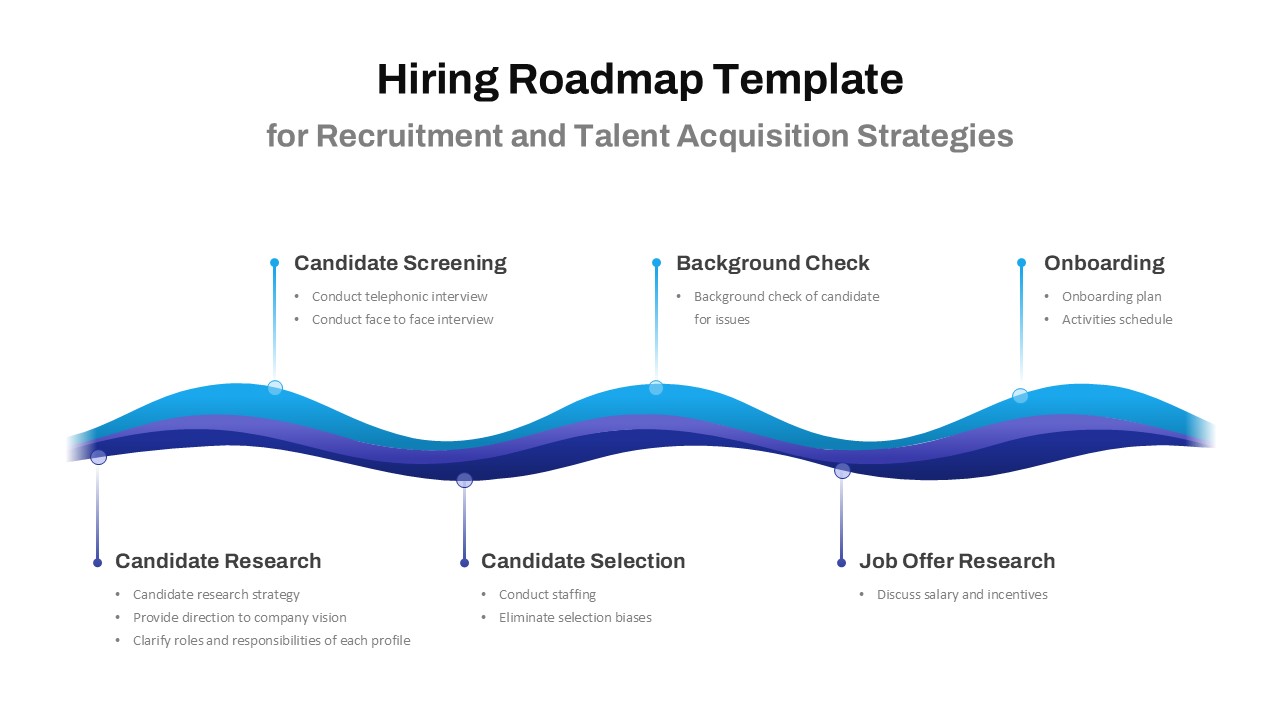

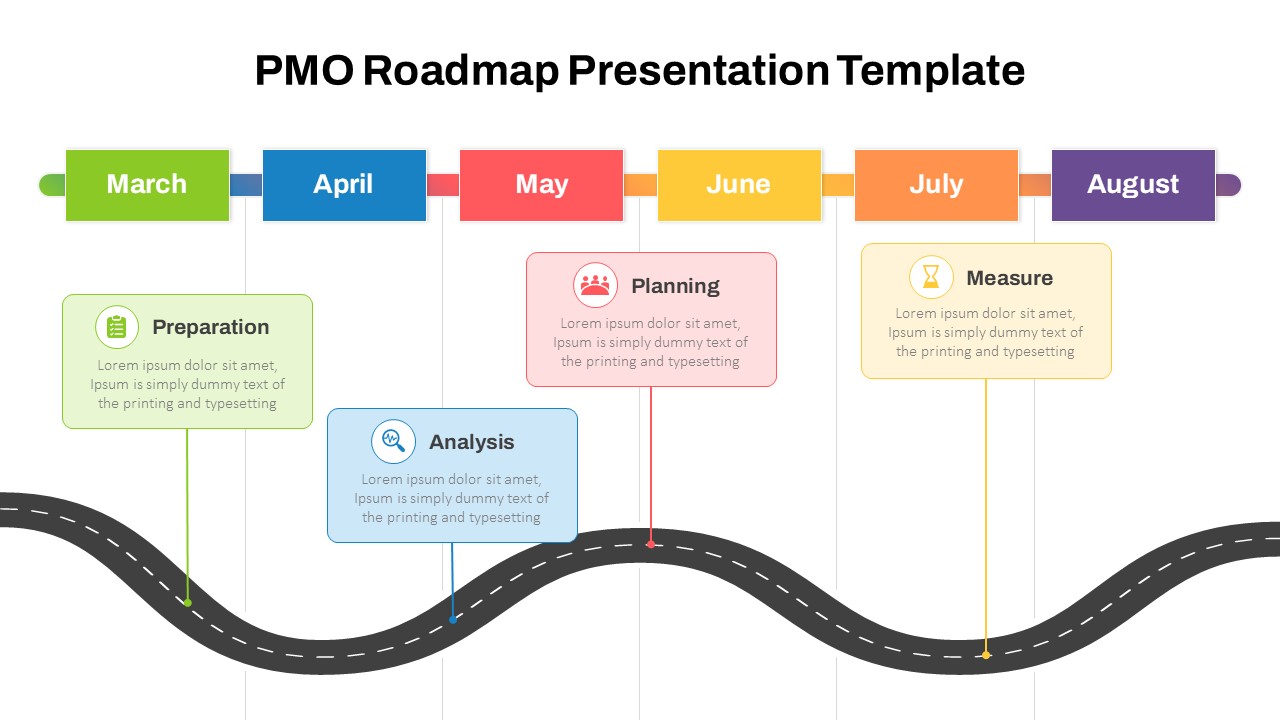

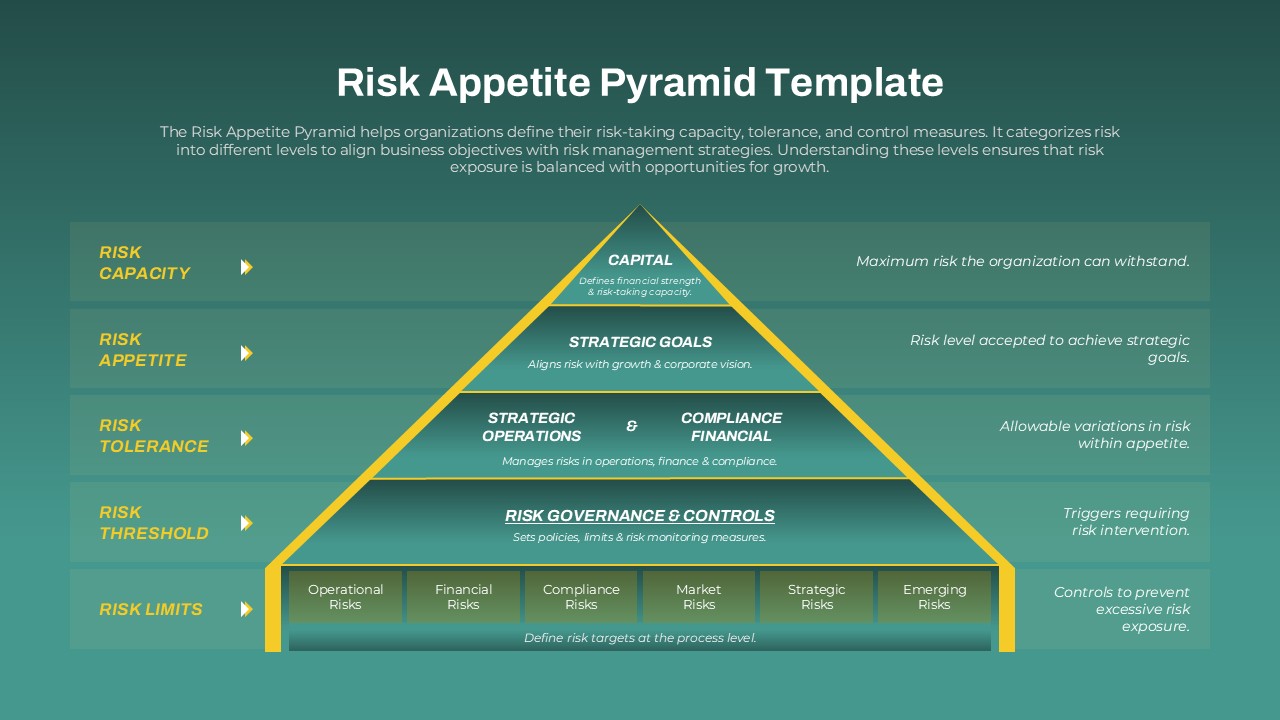

The synergies and value creation slide presents a before-and-after view of operations, costs, and combined capabilities. A clear integration plan and timeline helps users map out operational steps post-deal. Potential challenges are addressed with a Key Risk and Mitigation slide using a RAG (Red-Amber-Green) table, identifying critical issues and how they are being managed. The final thank you slide concludes the deck on a professional note.

Uses:

This M&A presentation is ideal for business consultants, corporate strategists, investment bankers, and MBA students. It simplifies the explanation of complex merger processes, making it suitable for internal team briefings or external stakeholder presentations.

Benefits:

Stakeholders benefit from clear, organized data. It enhances decision-making, improves communication between involved parties, and helps justify the merger or acquisition with facts and projections.

Customization:

Each slide is fully editable in PowerPoint. Users can modify company names, charts, diagrams, and text content to align with specific deals, industries, or audiences.

This M&A slide deck is not just informative—it’s a powerful tool for strategic communication in the world of corporate mergers and acquisitions.

See more

Features of this template

Other User Cases of the Template

Corporate Strategy Reviews, Financial Due Diligence, Investor Presentations, Business Valuation Proposals, Post-Merger Integration Plans, Executive Briefings, M&A Deal Negotiations, Boardroom Strategy Sessions, Stakeholder Communications, Corporate Development Roadmaps.