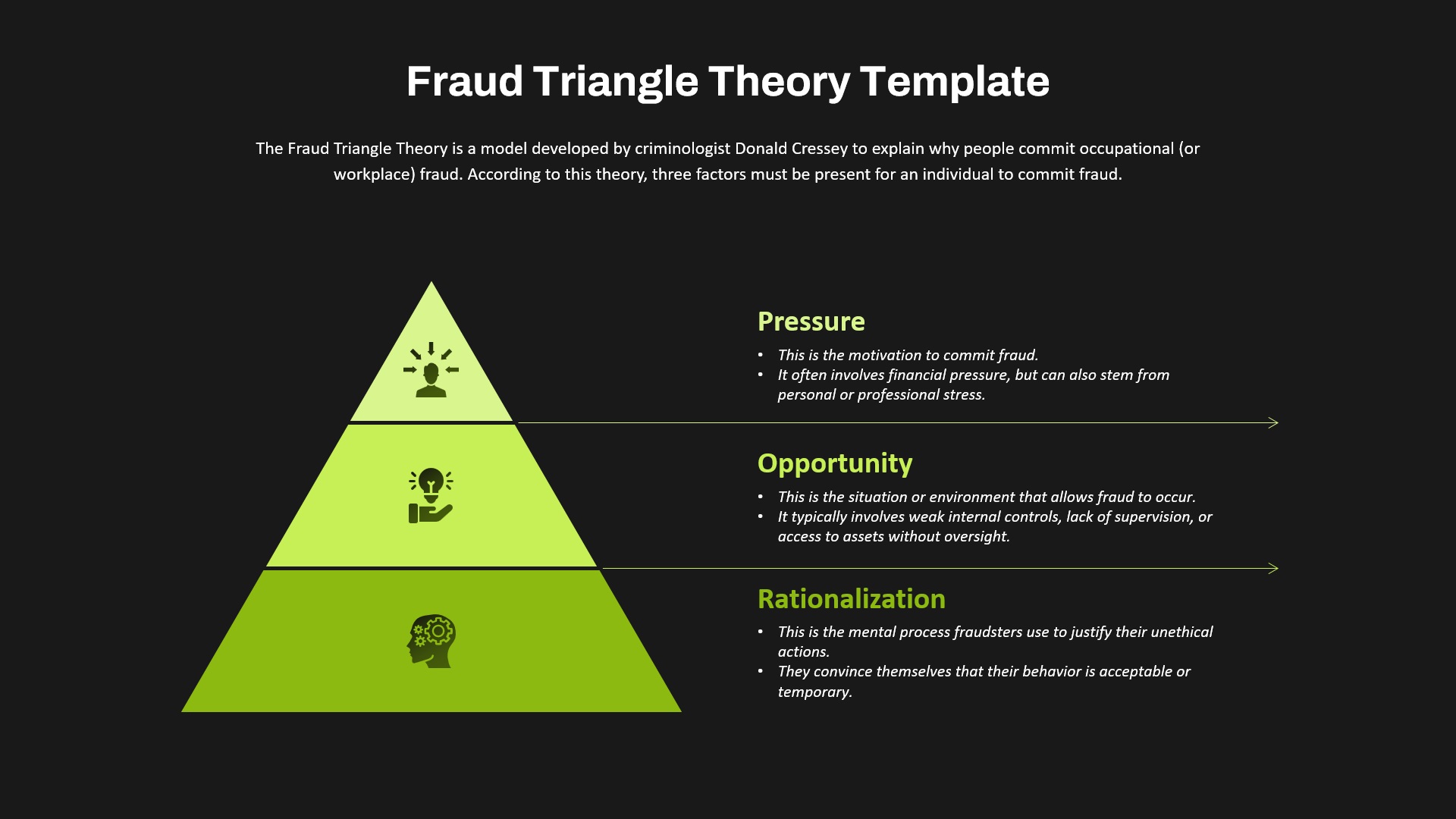

Fraud Triangle Theory PowerPoint and Google Slides Template

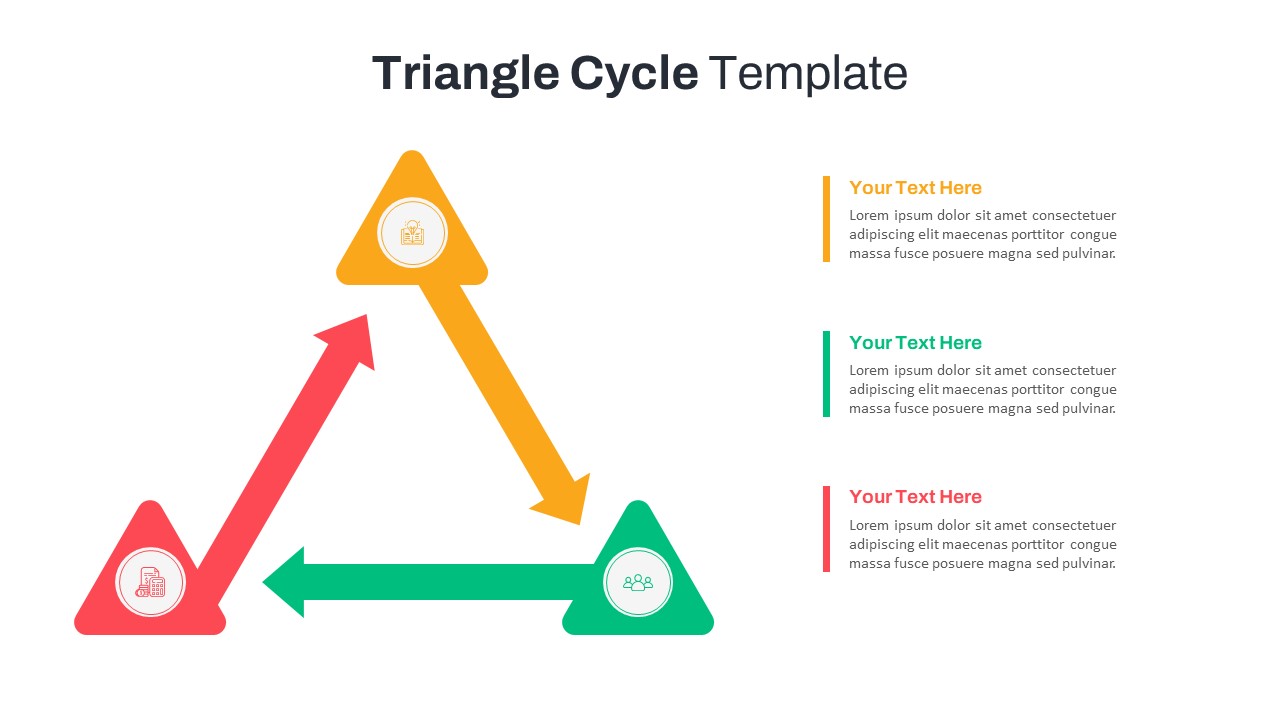

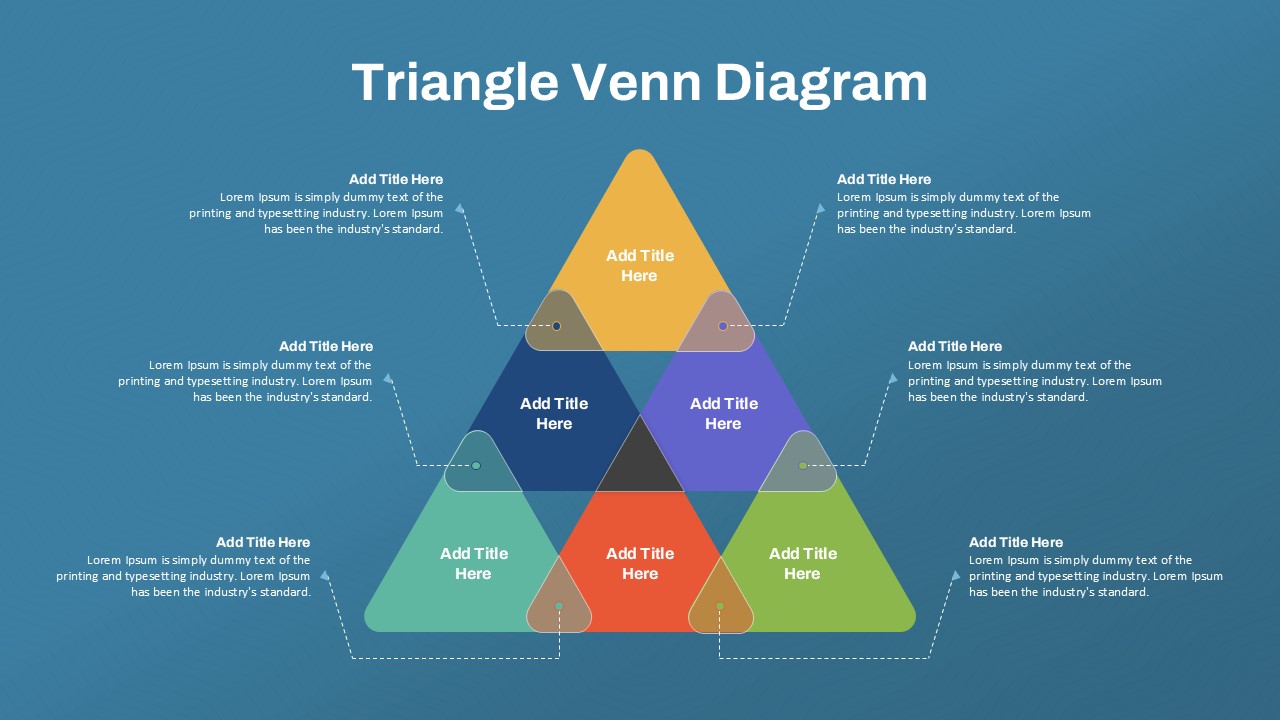

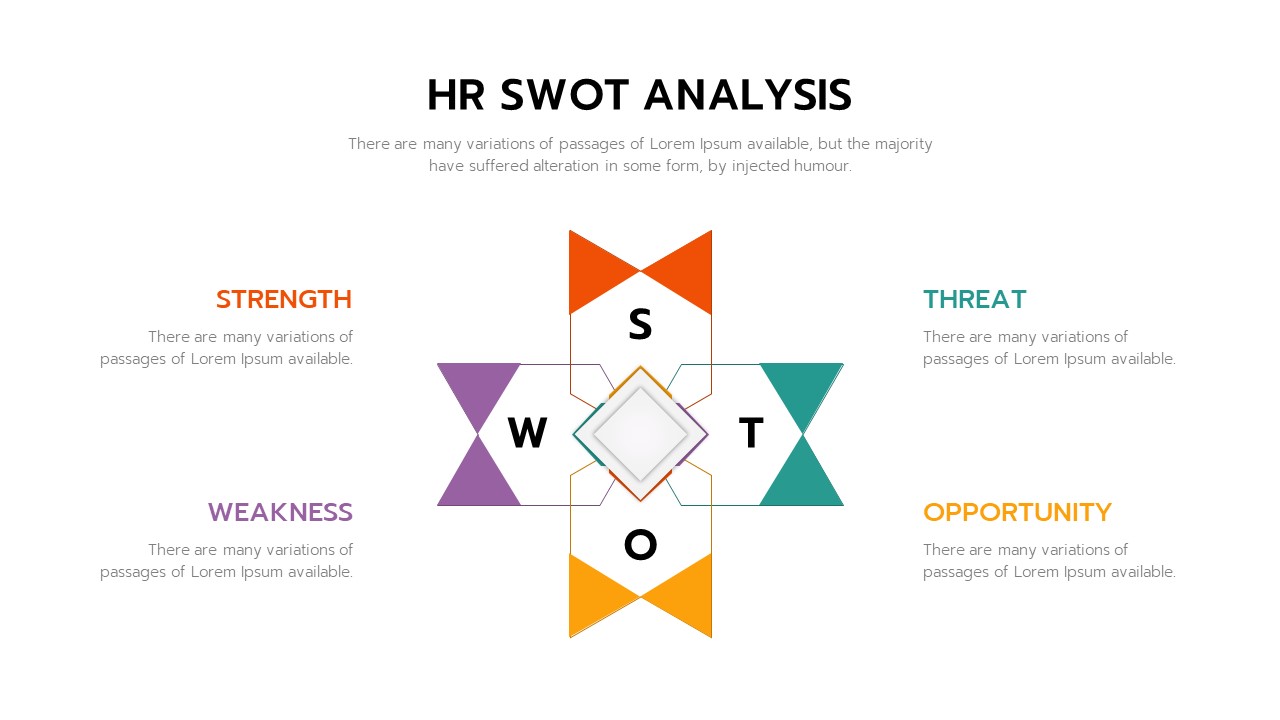

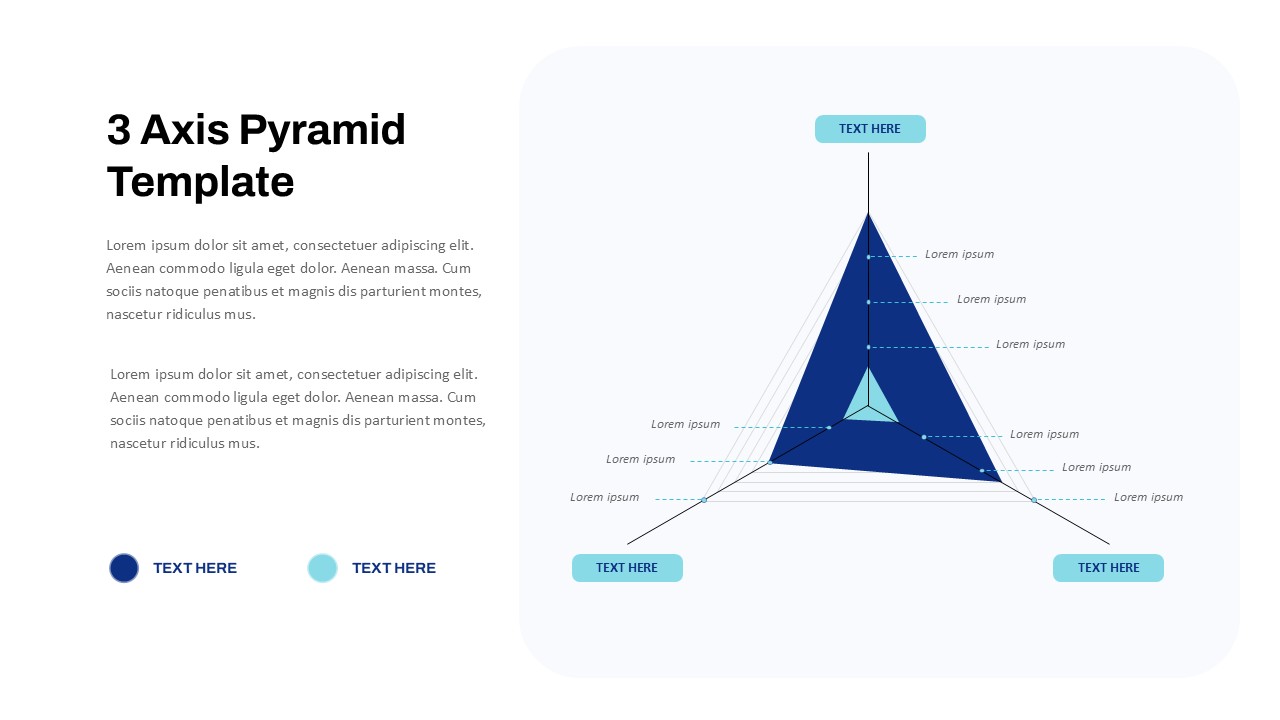

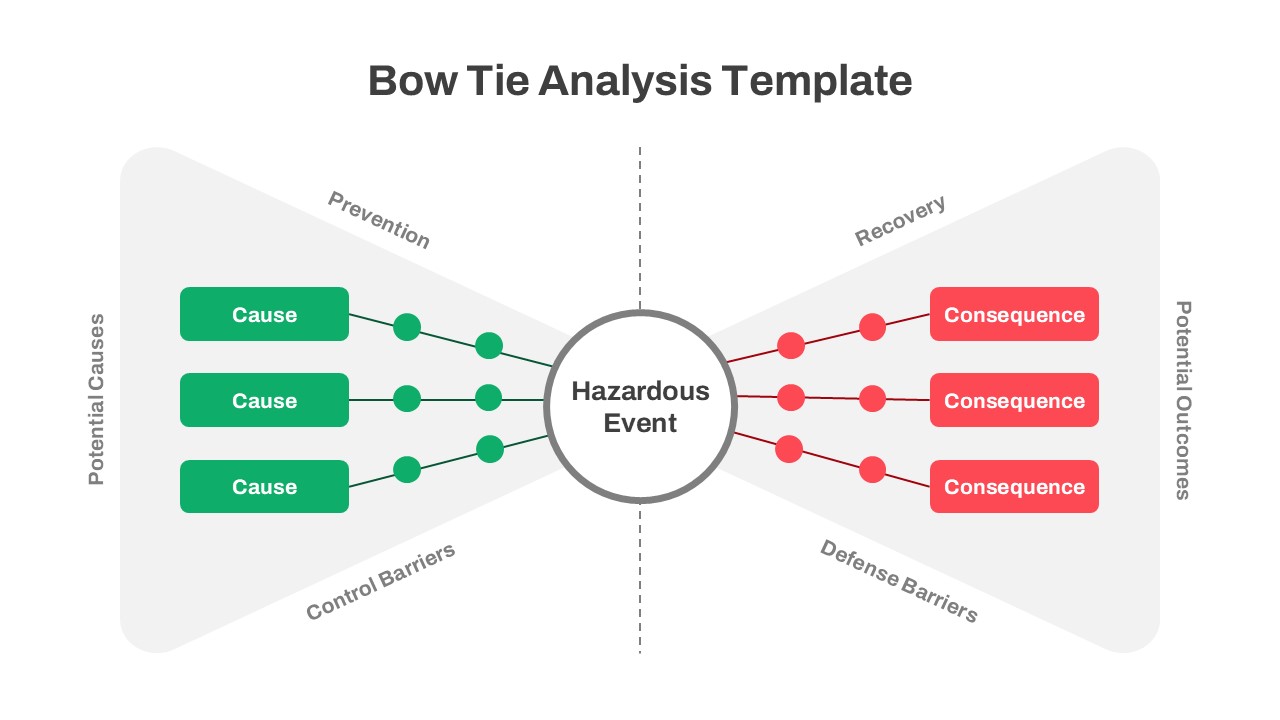

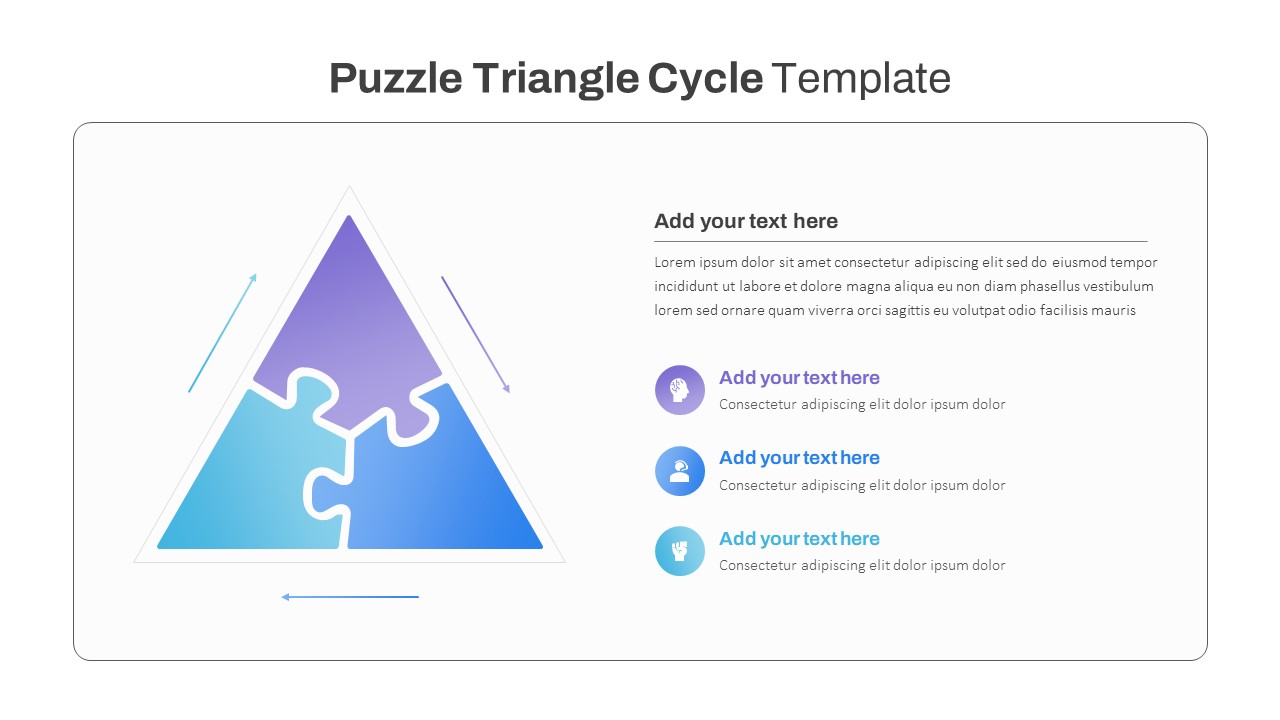

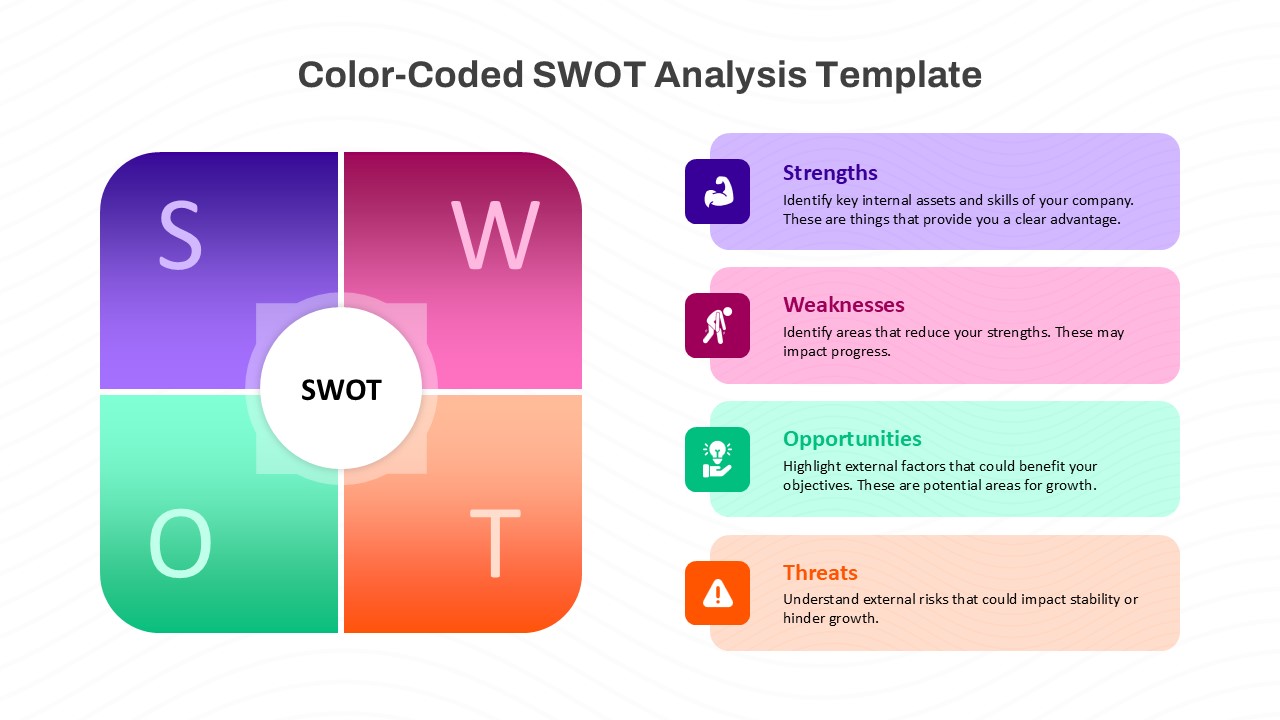

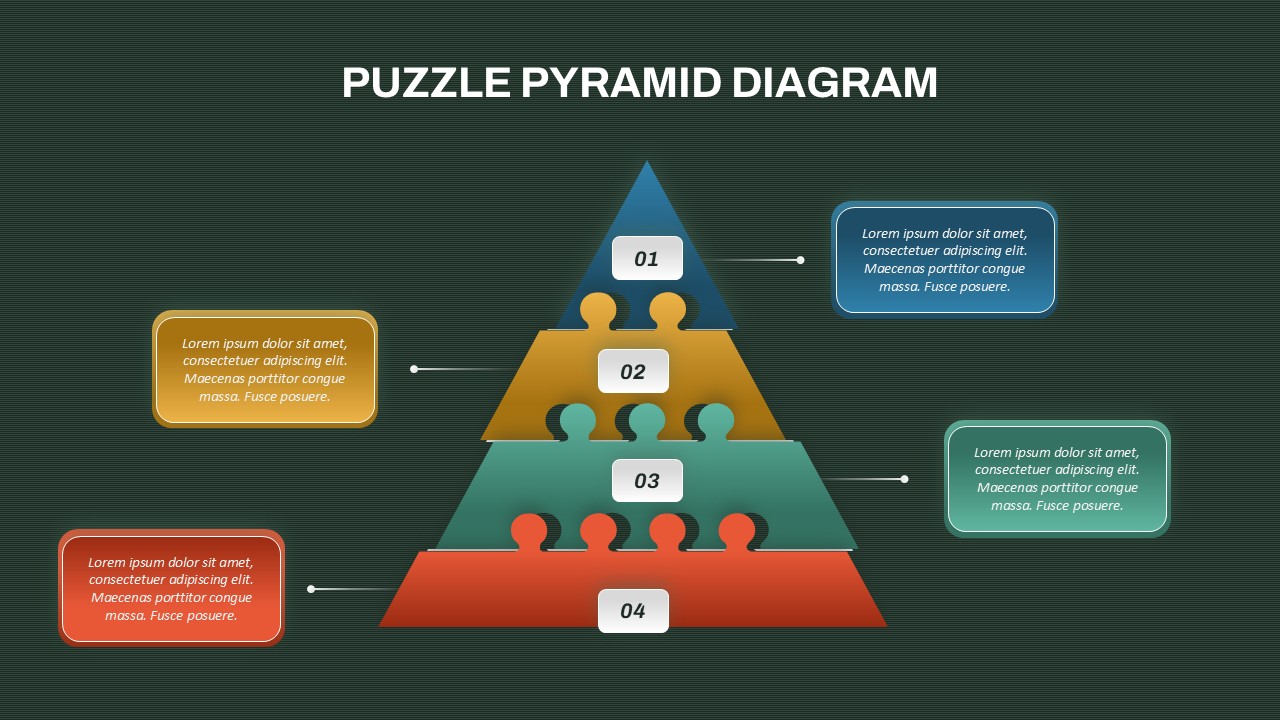

The the fraud triangle theory PowerPoint template provides a compelling and visually structured framework to explain the key factors that contribute to occupational fraud. Based on the widely accepted model developed by criminologist Donald Cressey, this powerpoint triangle template effectively breaks down the three core components of fraud—Pressure, Opportunity, and Rationalization—within a sleek triangular visual format.

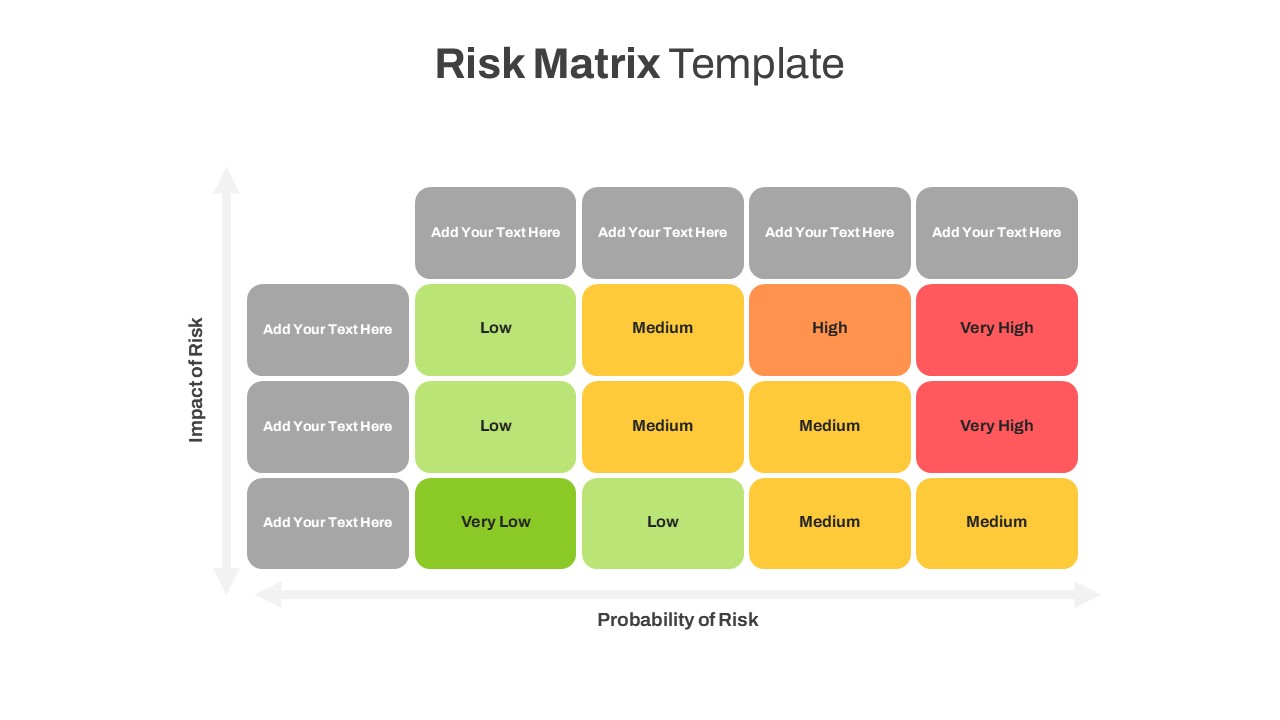

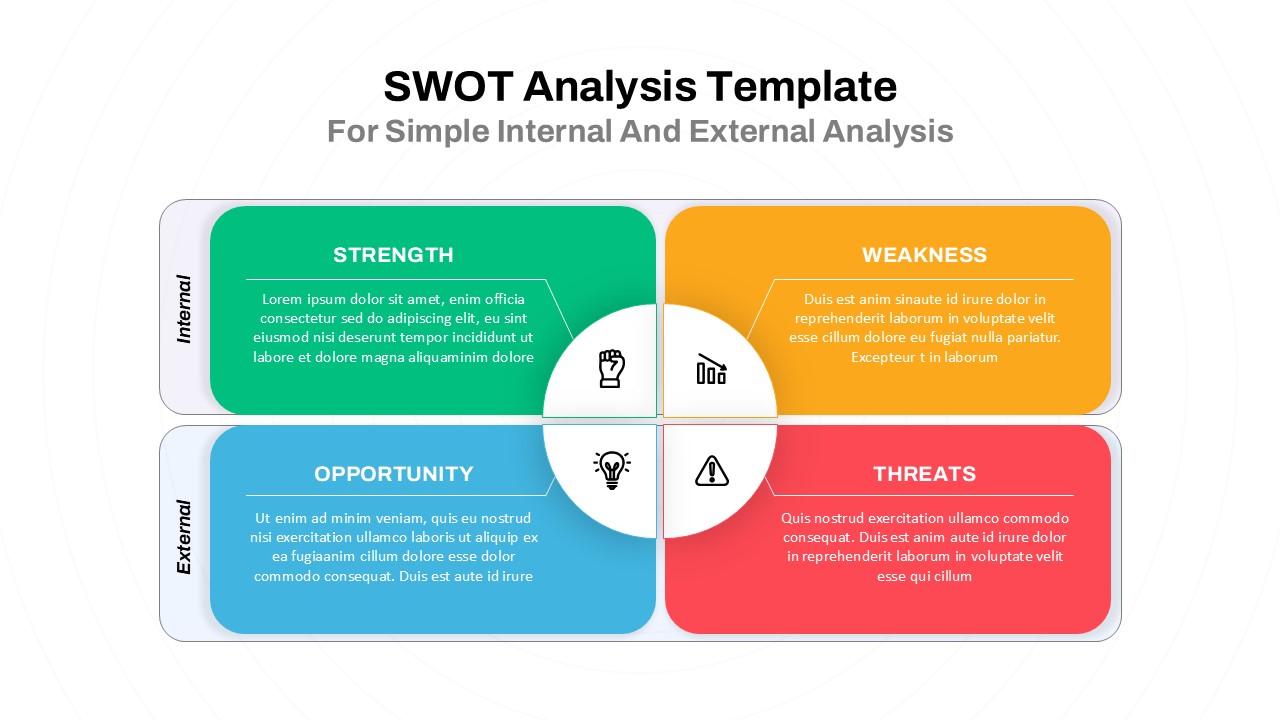

Each section of the triangle is distinctly color-coded and clearly labeled, making it easy for viewers to grasp complex concepts at a glance. The top segment outlines Pressure, the internal or external forces that motivate fraudulent behavior, often tied to financial stress or unmet expectations. The middle segment presents Opportunity, emphasizing how weak internal controls or poor oversight can create a space for fraud to occur. The base of the triangle illustrates Rationalization, the psychological mechanism individuals use to justify unethical actions.

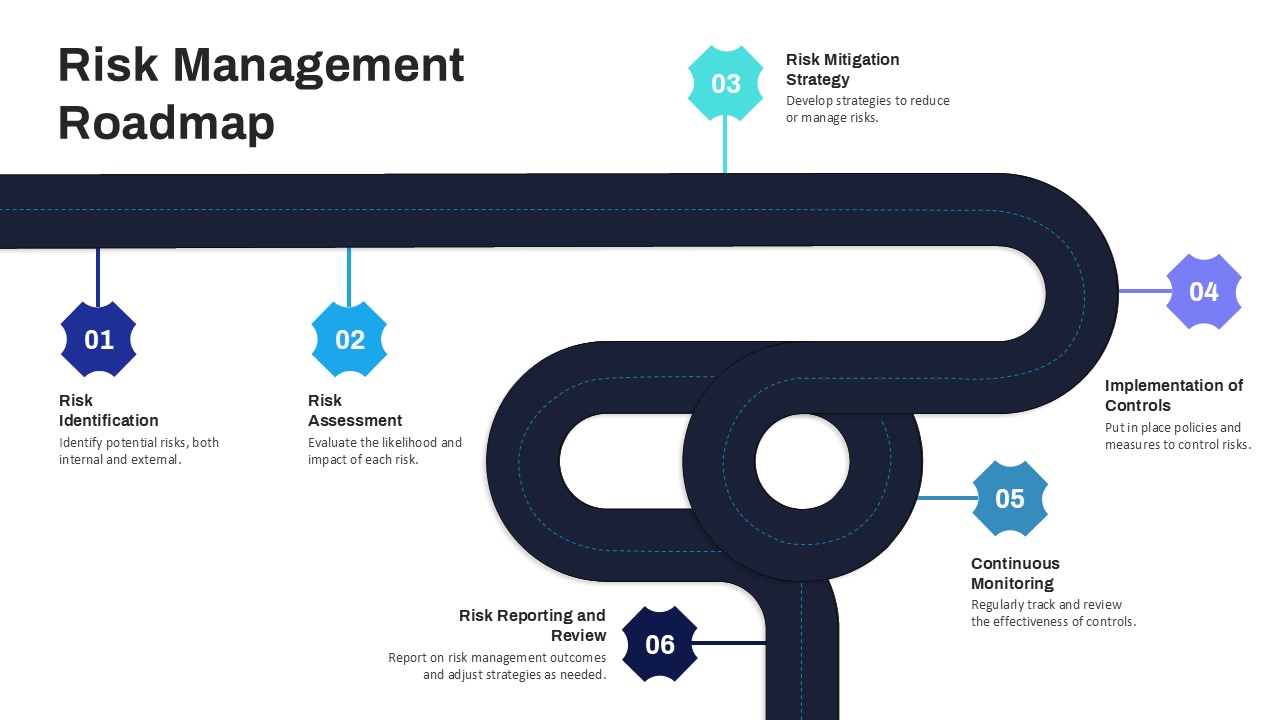

This triangle slide template is ideal for educators, compliance officers, auditors, and risk managers who need a clear, engaging way to discuss fraud prevention and internal control systems. The minimalist design and professional layout enhance comprehension, while the editable format in both PowerPoint and Google Slides ensures adaptability across industries and presentation contexts.

Whether you’re delivering a training session, conducting a seminar on corporate ethics, or analyzing risk factors in a business environment, this triangle presentation template serves as a vital educational tool to raise awareness and promote accountability.

See more

Features of this template

Other User Cases of the Template:

corporate ethics training, forensic accounting lectures, compliance workshops, internal audit presentations, business ethics courses, financial risk analysis, anti-fraud campaigns, HR compliance sessions, academic research discussions, internal control briefings